If you have noticed or have experienced, when a person gets admitted in the hospital the first question that’s been asked is “if they have any health insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More”. If the patient is already covered under a health insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More, they will be asked for an e-card.

An e-card, also known as an electronic health insurance card, is a digital version of a traditional health insurance card that is provided by health insurance companies to policyholders. It is a convenient and secure way to access medical services and benefits covered under a policyholder’s health insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. This is the single document that comes to your rescue at the hour of need and has more importance than any other document.

In today’s digital age, many insurance companies are moving away from traditional paper-based systems and are offering e-cards to their policyholders. An e-card is typically available through a mobile app or website, providing policyholders with easy access to their insurance information and benefits. This eliminates the need for policyholders to carry physical health insurance cards, reducing the risk of loss or theft and making it easier to access their insurance information on-the-go.

Who provides the E-card and when?

Once the insurance company issues the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More copy to the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More holder, the TPA or insurance provider will then provide an E-card to each member covered in the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. If the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More is meant to cover the entire family, then each member of the family will receive an individual E-card, equal to the number of members mentioned or covered under the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

Sample e-cards of various insurance companies and TPA’s:

What is the importance of e-cards in health insurance?

The importance of a health insurance e-card lies in its ability to provide policyholders with convenient and secure access to their health insurance information and benefits. Some of the key benefits of a health insurance e-card include:

- Convenience: An e-card eliminates the need for policyholders to carry physical health insurance cards, making it easier for them to access their insurance information on-the-go.

- Real-time access to insurance information: Policyholders can use their e-card to access their insurance information at any time through a secure mobile app or website, providing real-time access to their policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More details, claims status, and other important information.

- Improved experience when accessing medical services: By presenting their e-card to healthcare providers at the time of service, policyholders can verify their insurance information quickly and easily, reducing wait times and improving the overall experience when accessing medical services.

- Reduced risk of loss or theft: By eliminating the need for physical health insurance cards, e-cards reduce the risk of loss or theft, ensuring that policyholders always have access to their insurance information. (You will be surprised to know what kinds of frauds are possible in health insurance 🙂)

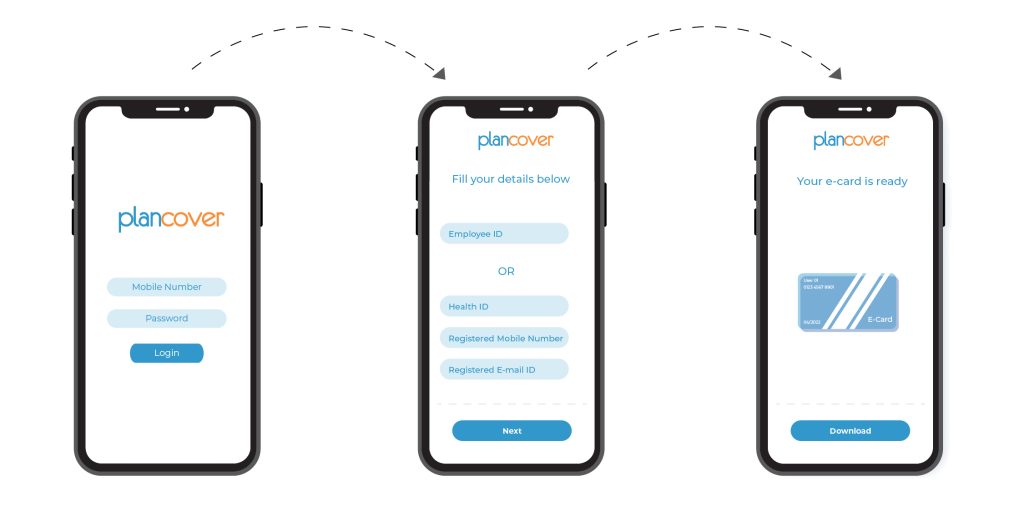

How can I have access to my health insurance e-card ?

While your health insurance provider would normally issue your health card to you manually along with the other policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More documents, you can also choose to download it online. This is a convenient option in case you couldn’t collect it personally for some reason. Here’s how you can download your health insurance e-card:

- Log on to your health insurance portal / mobile app and click ‘Download E-Card’.

- Enter your Health ID/employee ID/ policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More number or your claim ID.

- Fill all the other mandatory fields and click ‘View’ to verify and confirm your details.

- You can now download the E-Card.

An e-card provides real-time access to insurance information, reducing the risk of loss or theft, and improving the overall experience for policyholders when accessing medical services, e-cards are a valuable tool for both policyholders and insurance companies.

Is an e-card mandatory for claiming under health insurance?

Yes, an e-card is a mandatory document for claiming health insurance under normal circumstances. There may be situations where you can claim despite not having access to your e-cards. These are explained in detail below.

How can I claim health insurance when I don’t have my health insurance e-card?

PlanCover will help you in getting your cashless claim if you don’t have an e-card. In such cases, we will contact the TPA and request that they provide the necessary documentation in a formal email to both the insurance company and ourselves. Once we receive the required documents, we will coordinate with the insurance company directly to secure approval for your claim.

What can I do if my enrollment has recently been done and I don’t have my e-card?

There are 2 possible scenarios in this case:

- Your enrollment has been done from the insurer’s end but your e-card has not been issued.

- Your enrollment has not yet been done.

In the first instance: You don’t have to worry in case you don’t have your e-card yet. The e-card provides an easy way for the insurer or TPA to identify you in their records. It typically has your name and date-of-birth in it. This allows them to track you in their system.

In case you don’t yet have access to your health insurance e-card, you can use any photo ID proof issued by the government of India (Aadhaar, Passport copy, Driving License, Ration card etc) to initiate cashless. All these documents will have your name and date-of-birth. It needs to be ensured that both above are aligned to the details as provided in the insurance records. Please add your employee code and organisation name on the claim form ( or cashless authorization form) to proceed with the claim.

In case you may need any support on this, do reach out to us. Our team of experts have handled many such cases and are equipped to ensure that your claim gets through.

In the second instance: In case your enrollment is not yet done, this will at best be handled on an exception basis. There is no confirmation that the insurer will be able to extend cashless benefits at this point in time. The best case scenario is that assuming there is an advance premium kept by your organisation, then on an emergency basis the service spocs of the insurance company are able to pass an out-of-turn endorsement in their system. Once this is done there are chances that you can avail cashless despite not having an e-card.

What can I do if the name or date of birth or gender is incorrect on my health insurance e-card?

If the name, date of birth, or gender on your health insurance e-card is incorrect, you should contact PlanCover as soon as possible to get it corrected. Here are the steps you can take:

- Provide supporting documents: To correct any errors, your insurance provider may ask you to provide supporting documents, such as your driver’s license, birth certificate, or passport. Make sure to have these documents ready when you contact them.

- Check the accuracy of the information: Ensure that the name, date of birth, and gender are correct and match your official identification documents.

- Share these details with us: Once these are available to our team ( sometimes it may require to be routed through your organsiation), then we will share this in turn with the insurer. The insurance companies pass these endorsements on batch basis once a month.

The typical timeline for this can range from 3-5 weeks to get the updated ecard. The updated cards will be available on Rudolph, your policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More benefits administration platform for insurance.

It’s important to ensure that the information on your health insurance card is accurate and up-to-date to avoid any potential issues when you need to use your insurance.

Read more:

How to avail cashless hospitalization benefits using your mediclaim e-card?

How to file for reimbursement claim under health insurance using your mediclaim e-card?