Group health insurance plans are policies that an employer of an organization offers to their employees. The employer pays the premium so that the employees and their respective family members can enjoy the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More coverage. The various plans of group health insurances have diverse coverage rules influencing the overall premium charges. As a startup or a business, you can offer this service benefit to your employees. But not every organization is eligible for buying the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

Table of Contents

An overview of group health insurance

As an employer, your organization or startup should meet the eligibility terms for buying the group health policies. You may or may not include the family members under the health plan coverage through the group policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. The Mediclaim benefits are valid till the service period of the employees as long as you continue to pay the premium amounts. For buying the group policies, you can either connect to the sales representative of the insurance company or find an insurance broker.

Can all startups buy the policies?

If you have a legally registered startup or business and satisfy the eligibility norms set by IRDAI, you can buy the group policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. IRDAI (Insurance Regulatory and Development Authority of India) is the legal statutory body that sets the regulations for insurances in India. Thus, any startup has to check the terms and rules as stated by IRDAI to offer the group health benefits to the employees.

Eligibility norms for buying the policy

By going through the following eligibility aspects, you can understand whether your startup enterprise can offer group health policies to the employees. Read along to know more –

Defining the “Group”

As you can see by the term “group insuranceGroup Insurance is a type of insurance policy that covers multiple individuals under a single plan, typically provided by an More policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More”, the benefits are enjoyed by the people who belong to a group. The group has to sustain a few regulations for qualifying for policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More approval. According to IRDAI, the group comprises an employer-employee combination or a non-employer and employee combination. In a non-employer and employee group, both parties must share a common interest. The different groups may include club members, co-operative society associates, professional groups, startup organizations, etc.

What types of groups are eligible for group insurance?

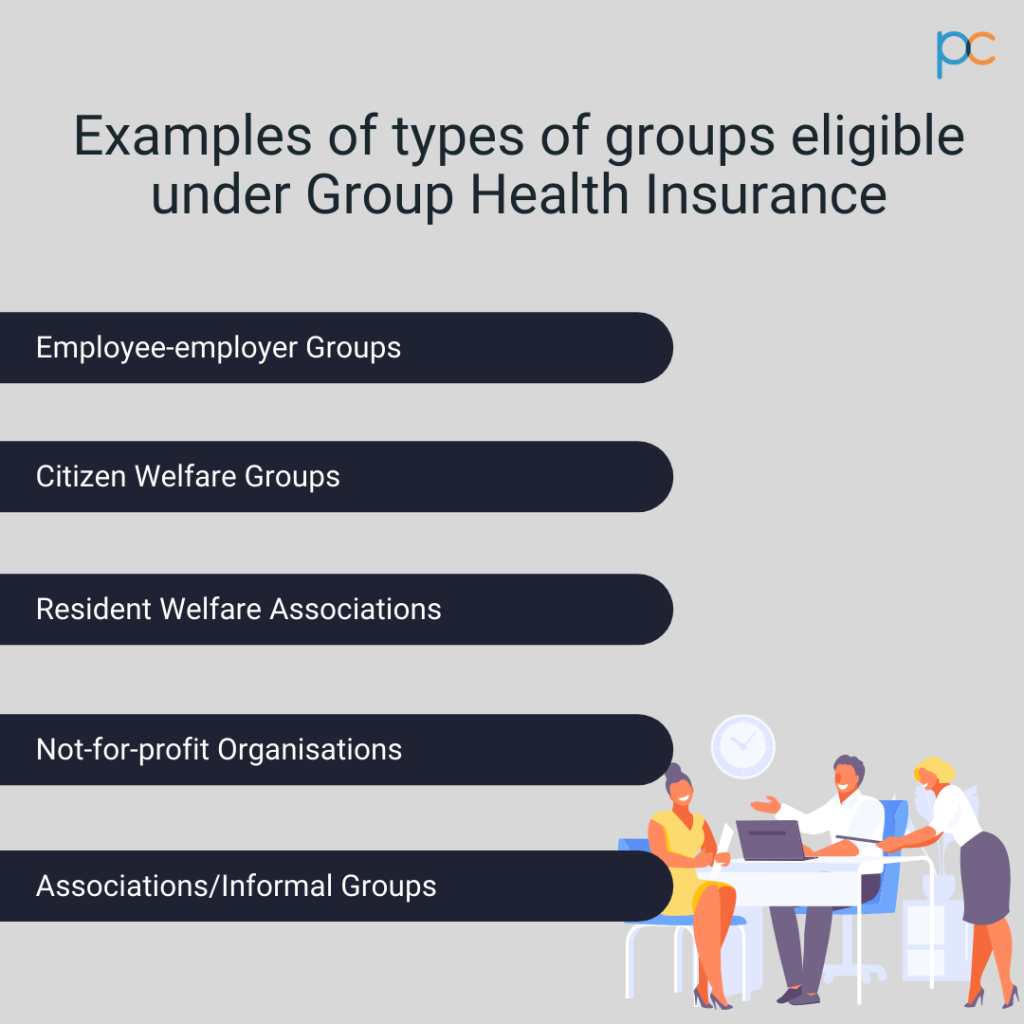

There can be two categories of groups that can qualify for the group health insurance plan. They are –

- Formal group – The formal groups are employer-employee groups. All professional organizations, companies, businesses, and startups fall under this category. Here all the employees work under one employer, who buys the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More for them. If you own a startup, then it would be considered as a formal group while applying for the employer health policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

- Informal group – Informal groups are the category where the employees do not work for the employer. A startup can not fall under this category as multiple employees are working under an organization. The different informal groups are – societies, cultural associations, etc. Even though they do not have an employer-employee relation, they can qualify for the group policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

Group dynamics – Does your startup fall under the exception rules?

For satisfying the eligibility norms, your organization has to have a minimum number of full-time employees. However, some provisions allow a startup or organization to buy the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More even if the number of employees is less than seven. There needs to be a specific group dynamic in the organization for qualifying this norm. If the complete workforce of the startup consists of contractual or part-time workers, then they can get approval for group health policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

The other provision is for the startups or companies having most employees over the age of 65. Usually, the group policies have an upper entry-age limit of 65, above which the members cannot fall under the plan coverage. But if the majority of the employees are over 65 in your startup or business, then you can apply for group health policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More through the specific group dynamics provision.

The minimum employee strength

Startup founders who are yet to establish a bigger enterprise can also qualify for the group health policies. If the company has seven or more full-time employees, then the employer can buy the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More for them.

As per IRDAI, the minimum employee strength in a business or organization should be at least twenty to get the policies. But, under certain provisions for small to midsize companies, the least number of employees can be as low as seven. However, the insurance company you pick has a significant role to play. The minimum number of employee criteria varies with the different insurance company rules and regulations. So, as a startup founder or employer, you have to talk to the insurance representative to understand if you can buy their policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

The right intent of the group

The intention of buying the group health insurance needs to be right. As per IRDAI, if the non-employer negotiates the price with the insurer before creating the group, then they cannot qualify for a group policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. In such cases, it gets considered as a non-legitimate group. Every member of the group should share a common interest or engage in economic or revenue-earning activity. It is a necessary criterion for getting the group policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More approval.

What about solo entrepreneurs?

Solo entrepreneurs who do not have any full-time or part-time employees working under the name of the organization cannot opt for such policies. You have to own an enterprise or establish a startup with at least seven full-time employees to get the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More benefits.

Family business startup and group policy eligibility

Startups can also be family businesses where the employees are related by blood. If your startup is such an example then you have to ensure that the group dynamics in the company complies with the IRDAI norms. If all the employees in the organization belong to a family, then the spouse of the employer will not qualify for the group policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More benefits. However, if there are non-family members among the employee list then everyone in the group can get the group insuranceGroup Insurance is a type of insurance policy that covers multiple individuals under a single plan, typically provided by an More coverage.

What if the employee strength reduces after buying?

Startups face a lot of uncertainty during the initial years of business. Even if you have bought the group health insurance plan for your employees, they may leave the job at any time point. Will your organization still qualify for the plan coverage?

As per IDRAI, the employee strength rule only applies when you are issuing the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. After you have bought the group health plan there are no such restrictions. Even if all the employees leave the job, it will not create any trouble with the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More coverage or continuation. But you have to ensure that before the next renewal date, the company should again own at least seven or more employees to get the annual policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More approval and continue to enjoy the plan coverage benefits.

Thus, as a growing startup, it is better to maintain the minimum employee strength throughout the year so that there are no chances of discontinuation or disqualification during policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More renewal.

Few points to remember for startups

When a startup founder wants to participate in a group health care policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More, then they need to know about a few things. Startup founders who qualify the eligibility norms, often ignore the following essential aspects that may lead them in trouble in the future.

- There will be only one master policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More for the insurance. The policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More gets issued under the name of the manager of the group and the name of the association, which is in this case, the startup.

- If it is a non-employer and employee group, then you will get a certificate that contains the following information – schedule of benefits, premium amount, and terms related to the coverage.

- The plan coverage will get canceled when the head of the group leaves. The group manager should disclose the premium and other expenses to the members present in the association.

Things to consider for startups while buying group policies

If your startup qualifies the above-mentioned criteria, then you start searching for an insurance plan to offer plan benefits to your employees. The group insuranceGroup Insurance is a type of insurance policy that covers multiple individuals under a single plan, typically provided by an More acts as a service benefit to the employees and they grow loyal to the company. Especially for startups who are establishing their grounds, the group policies are of great help in retaining the employees. You can offer similar plan benefits to your employees and their families by purchasing the right plan for them. But what features should you consider while buying the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More so that there is a mutual benefit? Check for the following five points to identify the best group policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More for a startup.

- Plan coverage: Check if the plan offers a comprehensive medical package to the employees and their family members to ensure optimal insurance utility.

- Tax benefits: When a startup owner buys the group insuranceGroup Insurance is a type of insurance policy that covers multiple individuals under a single plan, typically provided by an More policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More for the employees, they get a tax deduction for the premium payment. Thus, check the insurance company norms and rules that may help you avail of the tax benefits while filing the income tax.

- Affordability: Get a clear idea by comparing the prices of the leading insurance plans. You can either consult with the sales representatives of the insurance companies or find an insurance seller to help you out. Go for a premium package that you can afford to pay for the long term so that employees can enjoy the benefits.

PlanCover – Helping startups to find the best

Finding all the essential information about eligibility and plan coverage may be tedious on your part. PlanCover has got it covered for you. They have been providing group health insurance plans to small and mid-sized businesses and startups with employee strength between 7 to 450. They have the policies from all the leading insurance companies in India to help you check the best plan offerings. Consult their representatives to provide you with authentic information on specific eligibility rules that may be relevant for your startup. Connect to them and get started.