Organizations, businesses, and startups can offer group health insurance to their employees and family members. Under the insurance coverage, the employees can avail of medical expense coverage benefits without paying for the premium. The employer pays the premium for the employees and on behalf of their family members as.

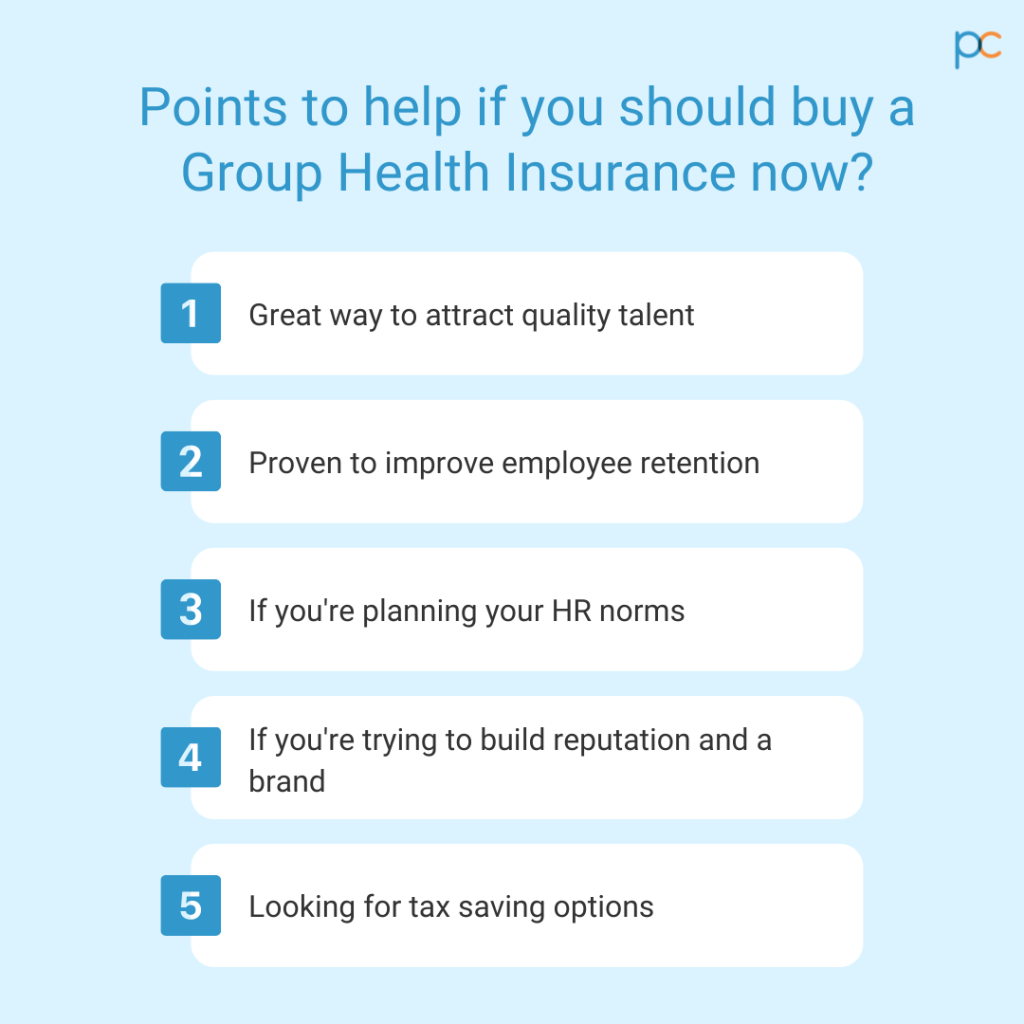

The dilemma that many small-scale and mid-size business owners and startup founders face is that when is the right time to buy it. In large-scale businesses, such employee-beneficial expenses do not create much difference. But small capacity businesses face a tough time finding the right opportunity. If you are an owner of a small business or a startup founder, this article is the right dilemma-resolver for you! Read along and find out the right time to purchase the group healthcare insurance plan for the employees in the organization.

Table of Contents

Understanding the right time to buy

Is there a suitable time for an employer to purchase the group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More for the employees? No, there is no specific time that is appropriate for the buying. The first thing you have to ensure is to get an idea of the eligibility criteria. IRDAI, the insurance regulatory body in India, has multiple regulations that determine whether the company is eligible for offering such benefits to its employees.

Are you eligible for buying?

The company specifications, employee strength, and much more decide if you can offer the medical coverage benefit to the employees. For businesses and startups, there is a minimum employee strength restriction that you have to follow. The company needs to hold at least seven full-time employees below the age of 65 to get the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More approval. However, there are special provisions to get the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More approval if the employee strength is less than seven or the employee age band is over sixty-five. Thus, if you have decided to buy the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More, first check with the eligibility norms by connecting to an insurance seller. The following discussed pointers are an essential part that helps in determining whether the timing is perfect for purchasing the employer healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

- Best Way to Increase Employee Retention

For startups and organizations who are still on their way to establishing a large-scale enterprise, employee retention is a very crucial factor. The resource requirement and cost of training an employee to meet the organizational needs are high. If they leave after training, you get back to square one! In such times, you have to search for something that will help the employees stay associated with the company. The group health care scheme covering the expenses for their families and themselves act as a great pusher. It makes them loyal to the organization by fearing the chances of losing the benefits. Thus, when you see more employees leaving your company, it is the right time to start thinking about the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

- While planning HR norms

The primary idea of creating HR rules for an organization is to ensure that the employees are getting their justified dues in return for their service. HR practices help in protecting the employee-welfare aspects that bring a long-term impact. It is also profitable on the employer’s part. How? Because, when an employee is satisfied with the company benefits, they work with more dedication to ensure their job stability. So, the next time you are consulting with the HR manager to structure the norms for your organization, include the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More in the plan.

- While expanding the business with recruits

Every business or company starts as a small enterprise. With time and growing business opportunities, the company expands. More employees join the organization while they see a growing prospect in the company. But how do you project to them about the company’s potential? Offering such employee benefits is a great way. When you look for new talents to recruit and expand the company, always mention the employee benefits that you offer. Among the many benefits, the group health policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More is a highly significant point that attracts attention. As the plan coverage is useful for everyone, they will automatically get attracted to the job offer coming on their way.

- While managing the company reputation

The goodwill of your company determines the profit-making possibilities coming in your way. The positive branding associated with your company name certainly impacts the minds of your market-peers and rivals. It not only brings fresh talents to the employee force but also brings business. Thus, buying the group health policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More while your company is facing a drop in the popularity index can be a masterstroke! It is effective for the existing employees as they get genuinely benefitted from the plan coverage. Be wise and take a good step to improve organization branding.

- While motivating the employees for better production

There are times when your employees require that extra push to work harder for the company. While increasing the salary may not always be a feasible option, the group policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More can act like a charm. It makes the employees feel valued and reflects your qualities as an able leader who considers the needs of the employees. It motivates them to work better for the company and, you get excellent productiveness in return. Thus, use it as a hack to improve the existing performance index by buying the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More now!

- While seeking tax benefits

Group health plans can be mutually profitable. How? Startups and small businesses can benefit from the tax reliefs as it releases their financial stress. For growing companies, it comes across as a boon when they can legally reduce the tax burden. By offering the group health policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More to your employees, you take the responsibility of paying the premiums. This helps in deducting the tax through legal provisions. So, if yours is a small-scale business, use the insurance plan as a tool to reduce tax and avail of the benefits now.

- While your company can afford

When you decide to offer the employer health plan to your employees, you have to prepare yourself for the financial responsibility for the long term. If you stop paying the insurance premiums, the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More benefits will get canceled. It will impact negatively on the employees and the reputation of the company. So, before taking the ultimate buying decision, first, understand if you can afford the expenses. The best way to find if the time is right for buying is by comparing the prices. An insurance broker can come to your rescue in such a case with a detailed report on price comparison. Check the offerings and premium packs to find the right blend of plan coverage under budget.

- While regulating salary structure and allowances

Launching the employee benefits during the annual appraisal result is a great way to keep the employees motivated to work better. While it may not be financially feasible to offer generous salary hikes, you can always compensate it with other benefits. A group health insurance plan can be an amazing substitute for this matter. Think wisely, the money you invest for the premiums gives you more than one return. It brings better productivity and tax relief. Thus, buying such policies during structuring the salary hikes and promotion benefits is a great thought.

- Discuss with employees to determine the necessity

What is the ultimate aim of offering medical coverage benefits to the employees? So they enjoy the plan coverage and reduce their financial burden of maintaining an individual Mediclaim policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. Hence, it is always better to ask the employees what they feel and if they want such benefits. As a leader or organization head, it is your responsibility to offer them benefits that are useful to them. Thus, discuss the features and benefits of the plan coverage with them to seek their opinion about it. If you see the majority in favor, buy the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More right away without wasting any time. Check the eligibility and expenses of the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More by connecting to an insurance company.

- Purchase it when you have found the right policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More

Lastly, the best time to buy the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More is when you have zeroed down the right insurance plan. But how do you find the best plan among so many options in the market? Different insurance companies have different health coverage schemes for the employees and their families. For identifying the best among the rest, you have to compare every policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More and its features.

Features that make a difference:

Following are some of the significant features that you must look for in the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More coverage to ensure the optimal utilization of the Mediclaim plan.

- Extensive plan coverage

- A wide network of hospitals

- Cashless facilities with swift processing

- Easy settlements and claims

- Affordable premium with best features

- Maternity coverage and childbirth expenses

- Lesser waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More for a pre-existing ailment

- A comprehensive package for employees and their family members

- 24/7 insurance support with dedicated assistance

- Accidental hospitalization coverage

Who can help you out?

The next step after you have decided to buy the group policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More is to find the one who can help you purchase it. One way to buy the plan is to directly contact a specific insurance company and buy it from their sales representative. The other way and the more sensible one is to find an insurance broker. An insurance broker or seller helps you get an overall idea of the existing group health plans in the market. With them, you can compare the features and prices to make the best purchase when you are ready to buy them.

PlanCover – Bringing it all together

PlanCover offers insurance plans to employers of small to mid-scale companies. You can find the best insurance plans with PlanCover as they offer insurance from the leading companies in the business. If your company employee strength is between 7 to 450, you can buy policies from the IRDAI-approved insurance companies through PlanCover. Reach out to their team to buy the best policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More under your budget.