Group Mediclaim policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More is one of the most preferred benefits offered to the employees. Any recognised group in existence, such as employer-employee, trade unions, associations etc can purchase a group mediclaim policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More for its employees. The features of any health policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More depend on the organization’s financial capability and its philosophy. One of the key facilities delivered by the organization to its employees is Corporate Buffer policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

Table of Contents

Corporate Buffer

Corporate Buffer is referred to as a creation of a pooled coverage that is maintained at an organization level. It aims to cater for its employees in case of a medical emergency, which falls under the list of critical illnesses. In some cases, the corporate buffer can also be approved by the insurer to be utilised for treatments in addition to critical illnesses. However, to utilize this benefit, the employee’s family floater coverage must be exhausted. Every organization manages a buffer of a certain amount. In case of need from an employee, the organization takes the decision of aiding the specific amount from the buffer. It mostly covers employees, their spouses and children.

What is Family Floater Coverage?

Family Floater coverage is identified as the plan that is extended to cover the entire family under one umbrella cover. Each family member of the employee enjoys the same sum assured under the common pool.

Identification of Family under Corporate Buffer

Generally, coverage in any policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More differs from organization to organization. It basically depends on the health benefits that an employer wants to cater to its employees. Under the corporate buffer policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More, most of the organizations provide coverage to only employees and their immediate families.

The immediate family includes spouses and children. It may or may not include parents and parents-in-law. It is the decision of the employer to include and exclude the family members. However, whatever the standard decisions may be, it is applicable to all the employees and the same is communicated to them from the beginning.

Criteria for Coverage in case of Independent Children

Some organizations put a clause on the coverage in the case of children. If the employee’s children are above a certain age or are financially independent, then they are not included in coverage under the corporate buffer policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

Criteria for Coverage in case of dependent Children

If the children of an employee are exceeding a certain age but have physical /mental limitations. Somehow they are still dependent on their parents, then they are included in the coverage.

Limitations on Number of Children Covered

There is a limitation on the number of children included in a corporate buffer plan. However, it can still vary at the discretion of the employers. In general the maximum allowed by the insurer is up to 2 children in a group policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

Process of availing Corporate Buffer

To avail of the corporate buffer, a standard request along with the supporting documents are required to be submitted by the employee to the employer.

- Medical reports stating the illness of the insured.

- A certificate from the doctor elaborates the medical procedure required.

- An estimate of the cost of the treatment including hospitalization, surgery (if required), medicines etc from the doctor.

- Medical attention required by the insured must fall under the category of “Critical Illness”.

- Medical records of the insured in need of treatment.

- Documents ensuring that the sum assured from the family floater plan has already been exhausted.

After assessing the documents received, the employer allows the employee to avail the benefit from the corporate buffer policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

Modes of availing Corporate Buffer Claim

There are mainly two modes of availing a claim through a corporate buffer policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

Cashless To avail the cashless services, the insured has to get the treatment done in the network hospitals empanelled with the insurance company. The hospital needs to be notified with the details of the insured person during the time of admission. Further, the hospital informs and coordinates with the insurance company for the processing of the claim.

Network hospitals are the hospitals that have a tie-up with the insurance companies.

Medical Card Medical card falls under cashless services. Some organizations provide a medical card to each of their employees, to shorten the entire process of claim. They intend to provide a hassle-free, and smooth experience of cashless services to their employees. A single medical card covers the employee and the family members in case of need.

Reimbursement Under reimbursement, the insured bears all the expenses related to hospitalization initially. After getting discharged from the hospital, the insured submits the forms and documents required to the employer and gets the charges reimbursed.

Critical Illness: Critical illness is termed as any ailment which impacts the major organ of the body and is life-threatening.

Why is Critical Illness Covered under Corporate Buffer?

- In general, a corporate buffer covers the employees and their families against medical emergencies like cancer, heart strokes etc.

- Because these illnesses or emergencies cost more than the average medical expense, they are excluded from the standardized group mediclaim policies.

- To reduce the financial burden of a sudden life-threatening disease from the shoulders of the employees.

- Additionally, the probability that the coverage will be utilized is low because of the nature of the illness.

List of Critical Illness

Every organization’s list of critical illnesses varies from one another. However, below mentioned are some of the basic illnesses that every organization includes.

- Heart attack

- Stroke

- Cancer

- Kidney failure

- Lungs failure

- Bypass surgery

- Brain surgery

- Heart Valve surgery

- Parkinson’s disease

- Loss of limbs

- Permanent paralysis of limbs

- Brain Tumor

- Radiotherapy

- Dialysis etc

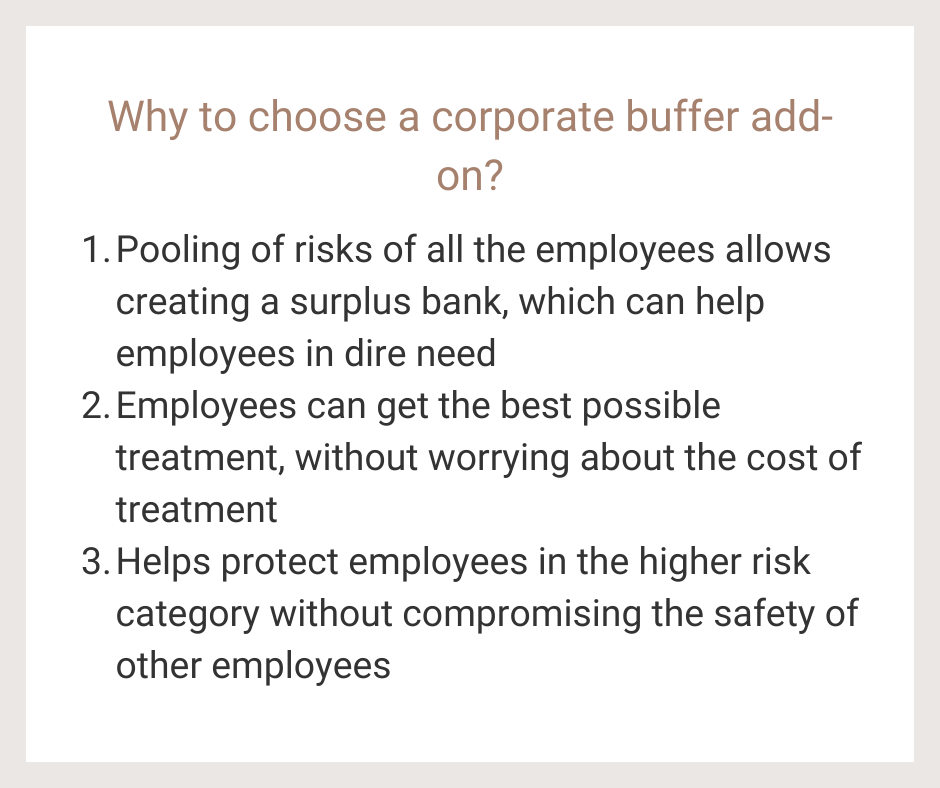

Why is Corporate Buffer Policy Catered to the employees?

The probability of a corporate buffer being used by each and every employee is on the lower side. However, organizations still prefer to create it because of the following reasons:

Employee’s Loyalty and Efficiency Employees today, look beyond the compensation offered to them. They vouch to work for an organization that provides them with a good mediclaim policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More and covers their family with extra benefits. They work more efficiently and with more loyalty for such organizations.

Employer’s Credibility A decent Corporate buffer policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More increases the employer’s credibility in the market. Employees stick to the organizations that shoulder their responsibility for health-related issues of their families. Even in the case of a sudden medical emergency, the employees need not run for support and can look up to their employer. In return, they work for the organizations with more determination.

What Cannot Be Covered Under Corporate Buffer

Maternity

Organizations may or may not cover maternity or maternity-related ailments under a corporate buffer policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. It is the discretion of the employer to decide whether it intends to facilitate its employee with this benefit or not.

Excessive Cost

The organization covers a certain amount of expense which is pre-decided and pre-approved. It produces a list, which underlines the benefits included under the corporate buffer. It additionally determines capping on each benefit. If the total cost of the treatment is more than the expected amount, then the employee will have to bear the excessive cost.

For Example: The cost of treatment of a heart attack given to the employee is Rs.250,000. The total amount includes hospitalization, medicine, surgery, doctor’s consultation etc. However, the organization where the employee worked approved the total claim of Rs.150,000. The capping limit under the corporate buffer policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More was individually reviewed, assuming the family floater plan to be exhausted. Thus, the additional charges of Rs.1,00,000 will be settled by the employee.

Limit on Room Charges

The room rent expense allowed under the corporate buffer policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More is pre-defined in every organization. If the per day charge of the room occupied is more than the limit set under the cover plan, in that case, the difference between the expense allowed and the actual charge of the room, will be borne by the employee.

For Example

The room rent approved under the corporate buffer policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More is Rs 3,000 per day, in the empaneled hospital. However, the insured occupied a single occupancy room with air conditioning facility, whose charges were Rs.7,500 per day. Thus, the difference amount of Rs.4,500 per day will be settled by the employee.

An employee earns a particular job on the basis of his profile. However, to stay and grow in a particular organization or to jump to the other one, depends on the organization’s work environment, benefits offered, health insurance etc.

Corporate Buffer is one such policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More that insures the employees with additional coverage in case of life threatening disease. It assures them that their families are in safe hands and they can look up to the organization in their tough times, without losing any hopes.