Whether small or big, business owners and founders work really hard to launch any business. From the office space to hiring employees, from marketing to inventory, a business is the coming together of thousands of different aspects. But all of it can come crashing down with just one small mistake. That brings us to business risks. Every business is vulnerable to risk and liabilities. Even with utmost care and security, threats and risks are common in businesses, leaving companies liable to different stakeholders.

Let’s look at some critical common risks that new and small businesses face today.

Risk related to data: With an increasing number of businesses having an online presence, the risks related to data breach, data loss, and others, are increasing.

Bodily injury and property damage to the third party: A vendor falling in your business premise and getting injured or a customer who got hurt using a product that was sold by your company, unexpected mishaps due to circumstances beyond your control can result in injuries or property damaged and you could be held liable for this.

Product-related risks: A company that manufactures, sells or supplies products can face several risks considering the large supply chain in product-related businesses. Even a small fault, such as an expired food product causing food poisoning could pose huge risks.

Table of Contents

What are liabilities?

The dictionary describes the term ‘liability’ as the state of being legally responsible for something. Businesses are liable to all its stakeholders — employees, investors, vendors, clients, and any general third-party. An employee getting injured in the office, a customer facing expenses because of a product that your business sold, or a competitor company facing losses because of advertisements that harmed its image and reputation. A business could be held liable for several such reasons.

How are small businesses liable?

In business, liability arises from any damage (bodily injury or property damage) occurring to a third party due to the company’s activities. At times, a particular company may not be at fault, yet gets sued and can be proven legally liable to a third party.

From the time a business entity comes into existence, it is exposed to a number of risks and hence, liabilities. These are the times when insurance can provide a cushion to businesses. In such a case, insurance coverage can help ease the burden of losses and expenses that a company might face.

What is liability insurance?

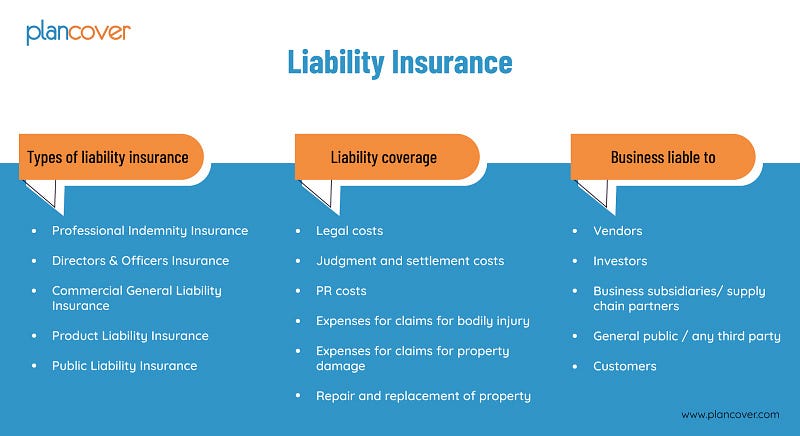

Liability insurance is also known as third-party insurance. It protects the insured business from the risks of legal liabilities arising from lawsuits filed by third parties against the business for bodily injuries or property damage. There are different kinds of liability insurance that provide coverage for different liabilities.

What are the types of liability insurance?

Commercial General Liability Insurance

The Commercial General Liability (CGL) Insurance provides financial compensation towards defence and damage costs a company might incur against a third party lawsuit, in cases where a company’s employees, products or services have caused bodily harm or property damage to the third party.

CGL provides coverage for:

- Third party injury — The CGL insurance will cover the cost of injuries to any third-party within your office premises. It covers the cost of medical treatment of injured individuals, legal and defense costs, court and lawyer fees, legal settlement and damages, and repair or replacement costs in case of property damage.

- Product Liability Protection — If your product causes property damage or personal injury to your customer or client, CGL will cover the costs you will be liable to pay for the damaged goods, including any legal costs if the client decides to sue you.

- Advertising Injury Protection — If your company is sued by a third party in relation to privacy-related matters, libel and slander, or for copyright and trademark infringement, the potential damages and legal fees could be covered by your CGL insurance.

Public Liability Insurance

Public Liability Insurance may seem similar to CGL Insurance, but there are differences between the two. The Public Liability Insurance provides coverage for bodily injury and property damage to any third-party within the premises of the business. CGL provides a broader range of coverage. In comparison to CGL, this insurance is cheaper as it provides less coverage. Smaller companies and those that are on a strict budget could opt for Public Liability Insurance.

Directors & Officers Liability Insurance

Directors & Officers (D&O) Liability Insurance protects directors, officers and the decision-making employees of a company against their actions and decisions that might have harmed a third-party and the third party decides to file a lawsuit.

The D&O policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More compensates costs and expenses related to legal defences, such as costs and fees that the company incurs to legally fight the case, bail bond, public relations expenses that the company might incur in order to protect the reputation of the company, and expenses for legal advisors or tax consultants.

Product Liability Insurance

Product Liability Insurance provides financial cover at times when a business is legally liable to pay for lawsuits that third parties have filed for bodily injury and property damage that occurred due to the product. The cases of defective products can be broad but the claims typically fall into three categories based on the reasons:

- A defect in the design of the product: When there are flaws in the basic design of a product

- A defect in the manufacturing of the product: Defects that have occurred during the manufacturing process

- An error in the marketing of the product: When the product is not accompanied by adequate instructions and warnings about the proper use of the product.

Professional Liability Insurance

A lot of businesses, especially today, are engaged in providing professional services. Consultants, too, provide services such as doctors, lawyers, IT consultants, accountants, architects, real estate agents, business management consultants, designers and more. Professional Indemnity Insurance or Errors & Omissions Insurance provides financial coverage towards legal claims filed by third parties relating to the services provided by a business. It provides compensation for settlement and judgment costs, legal costs and legal representation costs.

Cyber Risk Liability Insurance

Internet related risks and risks related to data are among the most critical risks faced by small companies and startups. Most companies turn to technology for better management, but this could lead to data breach and cyber attacks. The Cyber Risk Insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More can protect business from risks related to IT.

The coverage it provides:

- First-party losses: Direct losses accruing to the healthcare company that got breached. Coverage under this include data breach/privacy expenses related to management of the incident, legal costs, Business interruption (monetary loss) due to a network downtime resulting out of a cyber attack.

- Third-party losses: The costs suffered by related third parties — customers or partners — as a result of a cyber breach.

Benefits of purchasing liability insurances

Apart from the obvious benefits that liability insurance provides — that of a financial cushion during times when third parties legally claim for compensation for bodily harm or property damage caused to them by a business, there are other general benefits that liability insurance brings to a business. Small businesses can especially benefit from these factors. Here are some of the indirect benefits that these insurances have:

- Small companies can be assured that the insurance will mitigate losses and expenses arising due to third-party legal claims

- Small businesses can expand the market and scope of their business by gaining new partnerships, as often, serious business partners want to ensure if their partners are insured.

- It can help in enhancing the credibility of a business and keep different stakeholders happy, such as customers, vendors, business partners, investors, and board members.

- It can help startup companies gain the interest and trust of investors for gaining funding for the business, as investors often look at businesses that have a professional approach and have a risk management plan in place.

As you have read, the world of liability insurance is broad and has a broad range of scope and benefits. Most small businesses deal with third parties such as customers, vendors, investors, competitor businesses and others. For such companies, purchasing a liability insurances is a must. To explore liability insurance, to assess the liability risks for your small business, you could get in touch with PlanCover.