Table of Contents

Know The Working Ways Of The Group Health Insurance Covers Offered By Banks

Health insurances have become the need of the hour with the pandemic outbreak. Those in doubt about the utility of the Mediclaim plans, can witness the effectiveness of the insurances now! Having a healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More helps in reducing the financial risks when you face a medical emergency. Even with planned treatments, the healthcare policies help bear the estimated expenditure smoothly. Individual health insurances, employer or group health policies, floater healthcare plans, and so many other Mediclaim options, have made the choice convenient base on your specific needs.

The latest addition to all the existing healthcare insurances is the group health insurance provided by banks. Several banks in India are now offering customized group health policies to their valued customers. It is an excellent initiative for the bank account holders, as they no longer need to approach a third-party insurance seller or company to purchase a healthcare plan.

How is it different?

What makes the policies offered by the banks different from the rest? The first point to understand is that it is not a complimentary offer to the account holders. There are informal groups that offer such healthcare policies as a customer benefit, where the customers do not pay the premiums. In this case, the bank account holder has to purchase the group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

It is similar to any private Mediclaim plan that you buy from an insurance company but provides certain added benefits. The annual renewal charge for the healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More will automatically get deducted from the bank balance without any hassles. The option of buying group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More is more convenient for account holders and, especially the senior citizens.

Who decides the insurance norms?

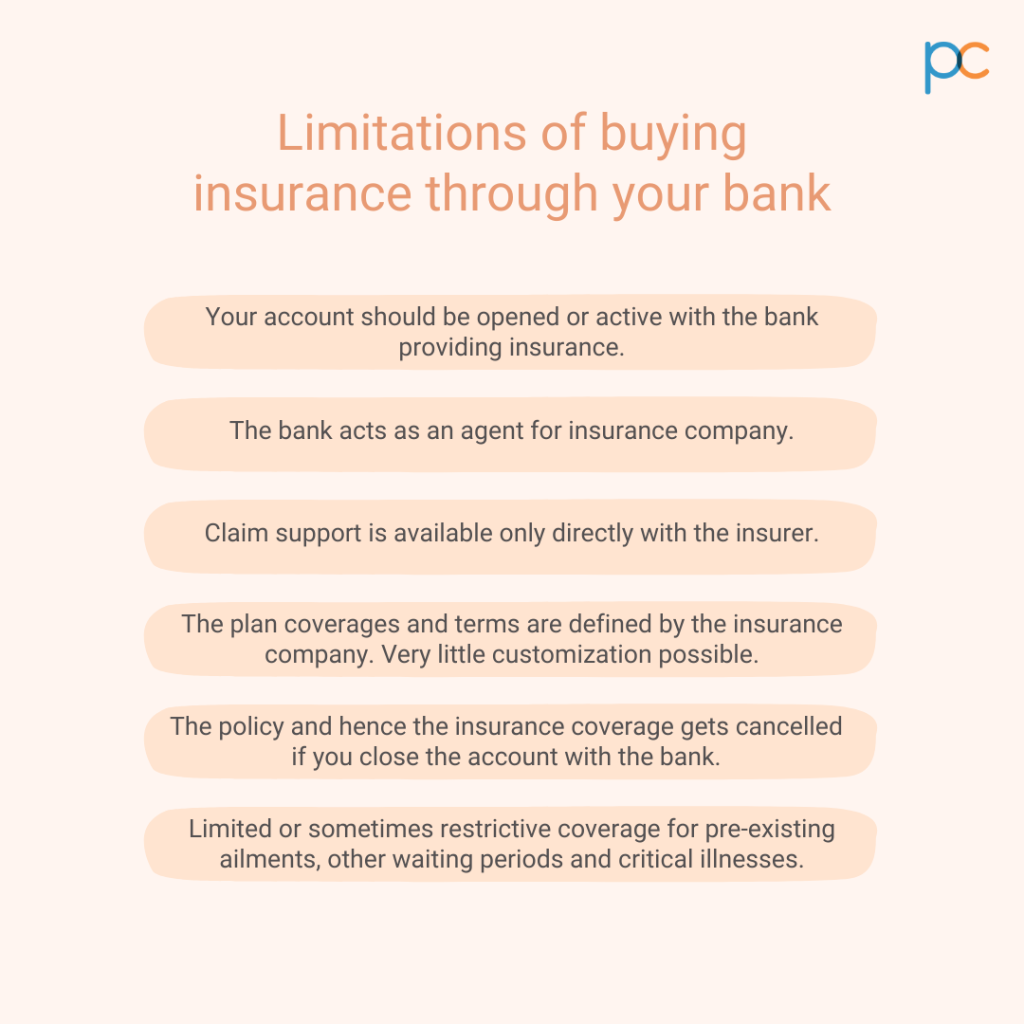

The rules are set by the insurance company, even though the bank sells the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More to the account holders. Different banks have tie-up with different insurance companies and, offer their group healthcare plans to bank customers. The features of plan coverage, approval norms, premium charges, and all other associated policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More terms get defined by the insurance company. Thus, in the case of any discrepancies or claim issues, you have to connect to the insurance company representatives.

Distinct features of the group healthcare policies

The plan coverage is similar to other group health insurance policies with some added features. However, the policies offered by the banks do not have add-on features or customizable options like the individual plans. The policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More only gets the features mentioned in the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More terms and cannot buy additional top-ups or increase the insured sum at any time point.

Read along to know how the plan coverage can work effectively for the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More during medical treatments and emergency requirements.

- Cashless hospitalization and treatment: The policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More can enjoy cashless treatment and, instant hospitalization with group health insurance. Like regular insurances, the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More can produce the insurance documents to get instant medical facilities in the hospitals. The hospital needs to be on the list of the approved network as mentioned by the insurance company.

- For senior citizens: One of the most valuable aspects of the group healthcare plans offered by banks is the overall cost for senior citizen account holders. Most insurance companies restrict the upper-entry age for policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More approval to sixty or sixty-five. Here, you do not face such troubles. The premium is also affordable compared to other premium rates offered by the different insurance policies. Therefore, these insurance plans are helpful for a senior citizen who still does not own a Mediclaim.

- Pre-and post-hospitalization expenses: With the group healthcare policies offered by banks, you can enjoy expense coverage for pre-and post-hospitalization. Not only does the insurance support cashless facilities during treatment, but it also provides expense support through claims. You can produce the medical bills and claim the pre-and post-hospitalization expense through the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

- Entry age and overall benefits: The entry age for the healthcare policies is another advantageous aspect. Even though different insurance companies have different regulations but the average entry age range is indeed better than the regular policies. For adults, the entry age ranges from 18years to 79 years in most healthcare policies offered through banks. For dependent children, the entry age is as low as five months age.

- Tax benefits: These policies also offer you scope to reduce the taxes. Like other individual or group healthcare plans, these insurances have a tax relief offer. Under section 80D, you can get a tax cut in the total income tax amount. You need to produce authentic documents to prove the premium payment to avail of the tax cuts.

How long will the insurance provide coverage?

Are these insurances valid for a lifetime? Well, it depends on your decision. Why? There are two ways through which you can discontinue the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. If you stop paying the premium charges, then the insurance gets cancelled. The other important point to note is that you can only enjoy the plan coverage till you own an account in the bank. If you close your account or keep a dormant one in the bank, the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More will get cancelled. To continue getting the plan benefits, you have to keep an active bank account.

How can you buy the policy?

For buying the group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More through the bank, you do not have to approach an insurance broker or company. The representatives at the bank will help you with the process. They have a tie-up with any of the leading IRDAI-approved insurance companies, whose policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More you can buy through your account. Before buying the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More, you should always read the terms and regulations attached to the specific insurance so you can enjoy optimal plan coverage, apt for your needs. With the existing pandemic conditions, you can also buy the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More through the online portals of the bank.

An overview of the prices

As different banks have different insurance policies to offer, you cannot figure out the exact amount. You have to approach the bank representatives to get the actual figure. For example, in Union Bank of India, the insurance provider is New India Assurance. If you are a senior citizen applying to get a couple-healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More worth Rs.1 lacs, the premium would cost you around Rs. 8,400/- (including GST). This way, the renewal rates can vary with the opted plan and coverage benefits.

Should you continue the existing policies simultaneously?

While there are multiple benefits of having the group policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More through a bank, there are demerits also. The most prominent drawback is that you cannot customize the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More as per your needs. It is a major disadvantage for those having pre-existing ailments or critical illnesses. So, it is better to keep other healthcare plans (individual and employer healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More) alongside this insurance.

PlanCover – Helping employers to find the best policies.

PlanCover helps employers find the best group policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More for the employees working in their organization. The highly reputed insurance broker company, PlanCover brings several group healthcare plans from the leading insurance companies in India. Connect to them and identify the best policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More to suit their needs.