The importance of having group health insurance for the employees is the same with businesses and organizations of varied sizes. Small businesses can avail multiple benefits by providing their employees with insurance. Better employee retention, tax benefits, and so many other advantages make it a must for small business owners to find the right insurance provider for their employees. Apart from finding the right insurance provider, knowing about the qualifying pointer of getting the insurance is also essential.

Table of Contents

How does Group Health Insurance Work for Small Business?

Before getting into details of the selection process and finding the best resource, know about the buying steps. As the small business group owner or HR personnel, you have to ensure that your organization falls under the qualifying category for buying the insurance.

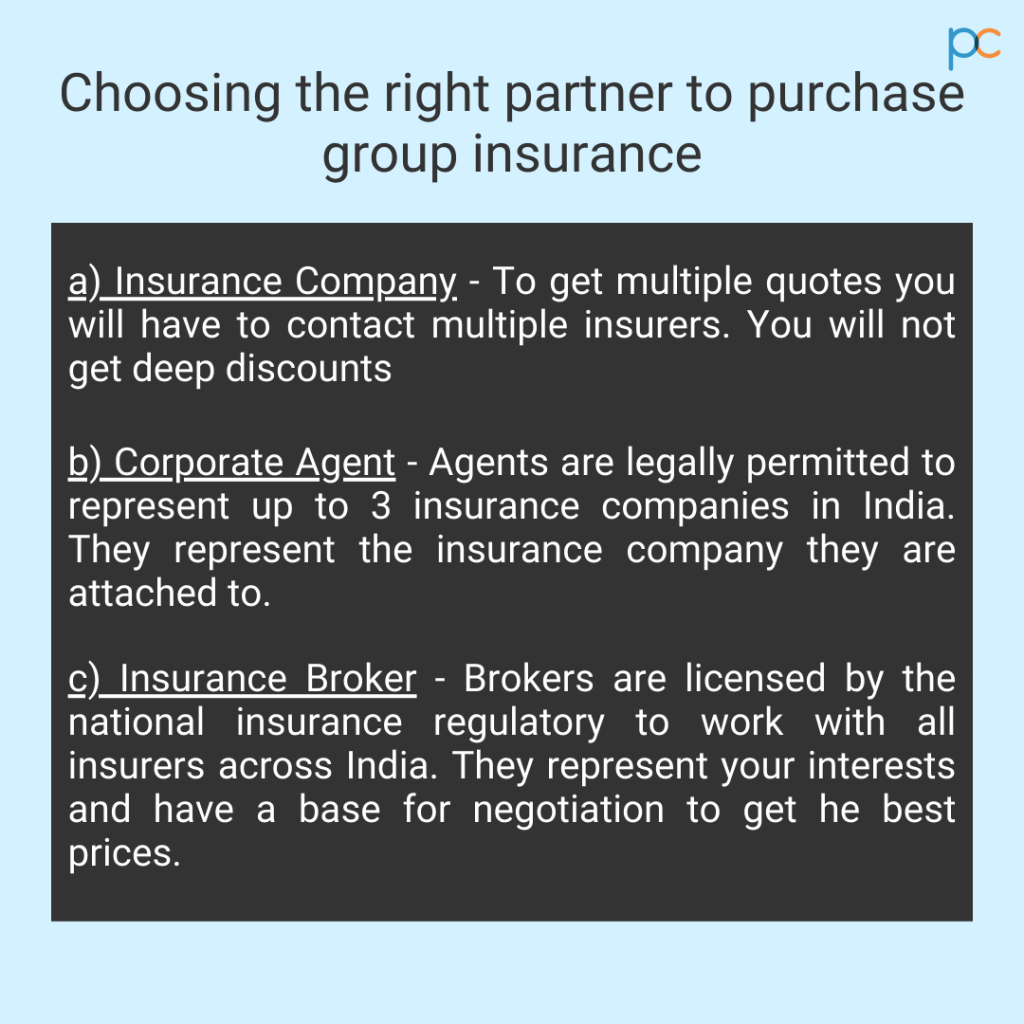

- Whom to connect to? – You can either consult with the insurance company’s representatives whose policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More you are going to buy or find a reliable insurance broker who supports the insurance buying requirements of the employers. You can connect to PlanCover, which is one such top-rated insurance broker to select the best group health policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More by reviewing all the options at their end.

Things to remember when choosing Group Health Insurance

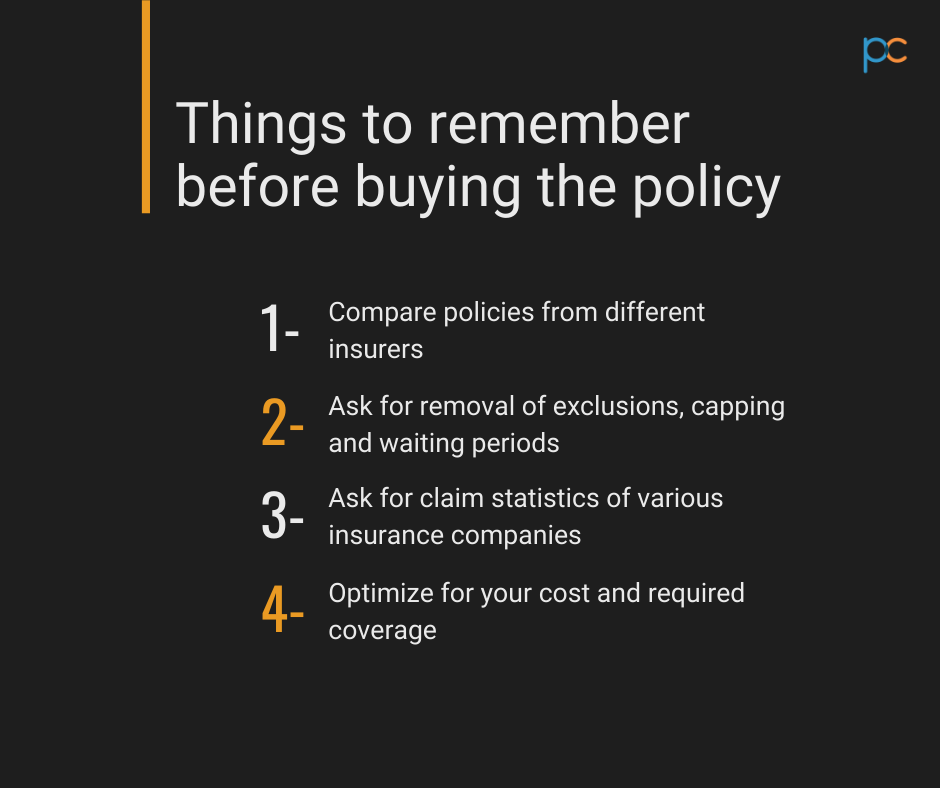

As an employer, you need to gain a clear idea of the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More regulations before buying them. A hurried decision may not be a very wise step on your part. Thus, you must review the details and qualifying norms, irrespective of what policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More you pick and through whichever source(direct or insurance broker). For making your selection task easier, here are some of the core features related to the group health insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More that you should check before buying –

Number of employees needed for group health insurance

According to group business guidelines in India, your small business organization must follow the minimum employee-number guideline. Your organization should have employee strength in excess of 6 employees. The employees have to be full-time working at your organization and hold legally valid certifications of their employment.

Know Benefits of Group Health Insurance Plan

Before finalizing a particular group health insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More from an insurance company, know the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More offerings. The best way of finding out authentic information is by consulting professionals. If you are buying the insurance directly from the company, connect to their representatives. Else, if you are going through an insurance broker, talk to their client assistance team about the features of each of the policies available under their schemes. Here are the things that you must enquire about –

- Detailed calculation of the premium against each employee and the whole expense

- The limitation of the insurance for cashless hospitalization

- Insurance offerings and coverage depending on the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More amount

- Tax relaxations against the policy

3. Know the limitations and exclusions of Group Health Insurance

The amount insured is essential in health policies, but gaining an overall idea about the limitations of the insurance is also a must. The network of hospitals, the treatment coverage, Pan-India insurance coverage, cashless treatment, reimbursement guidelines, and many more play a key role in reaching a decision. As you will be responsible for selecting the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More for your employees, you have to take a prudent call. Alongside checking the benefits, do not forget to clarify the limitations and non-coverage areas in the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More you will buy.

Where Can I buy Group Health Insurance?

Buy from the right insurance company

Identifying the best insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More and buying resources are the key points. You cannot make a fruitful decision without prior evaluation and inquiry. With so many group health insurance policies available in the market, it can be confusing at times. Hence, understanding the pros and cons of each policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More is a must. Here are some of the useful ways to buy the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More –

- Compare before buying the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More: Comparing the policies of different insurance companies is a must. For this, it is always better to go for a trustworthy insurance broker who has multiple offerings at their end. Ask them to provide a detailed presentation of which policies to shortlist and the prime features of the associated group health insurances. This way, you can easily decide the right option among many alternatives and confer the best to your employees.

- A comprehensive plan for employees: Getting a compact health insurance plan for the employees helps make your business grow better. How? When employees see the employer putting effort into their overall well-being, they grow loyal to the concern. Thus, make the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More a tool for better employee retention. Go for policies that cover most treatments, offer cashless and reimbursement facilities, dedicated support for an insurance settlement, covers expenses related to medical accessories, family treatment support, and many more. You can either ask about these directly from the insurance company’s representative or consult with an insurance broker.

- Cost to the organization: Checking the cost to the organization is among the most important points when it comes to buying group health policies for your employees. The cost you can afford for the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More determines the final selection for policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More type, coverage amount, coverage benefits, and insurance support for the employee’s family. Take an inclusive decision that benefits both the business and the employees by finding the best policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

Connect to professional insurance brokers

For buying the group insurance policy, there is nothing better than connecting to a reliable insurance broker. PlanCover, a reputed name among the leading non-life insurance broking fraternity, can be the right choice for enquiring about buying needs. They have ready policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More plans and can also customise the plans suiting the requirements of small-scale businesses from multiple top-rated insurers. You can connect to the assisting team over a call or an email, and their representatives will help you compare the best options that suit your criteria.

PlanCover also takes care of all the necessary documentation and paperwork for helping you buy the best group health insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More for the employees. Get all the answers to your queries related to insurance from qualified and expert professionals. Reach out to their team now.