Startups, businesses, and organizations need a well-planned employee-welfare plan to ensure a high-performing workforce. Group health insurance policies can be a motivating force for better performance and act as a part of the employee-welfare schemes. How? The insurance plan is also called an Employer group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More as it provides medical benefits to the employees as a part of their service grant. The employer buys the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More and continues it throughout the service tenure of the employee by clearing the renewal premium amount.

Read along to understand how the group healthcare insurance benefits both employers and employees.

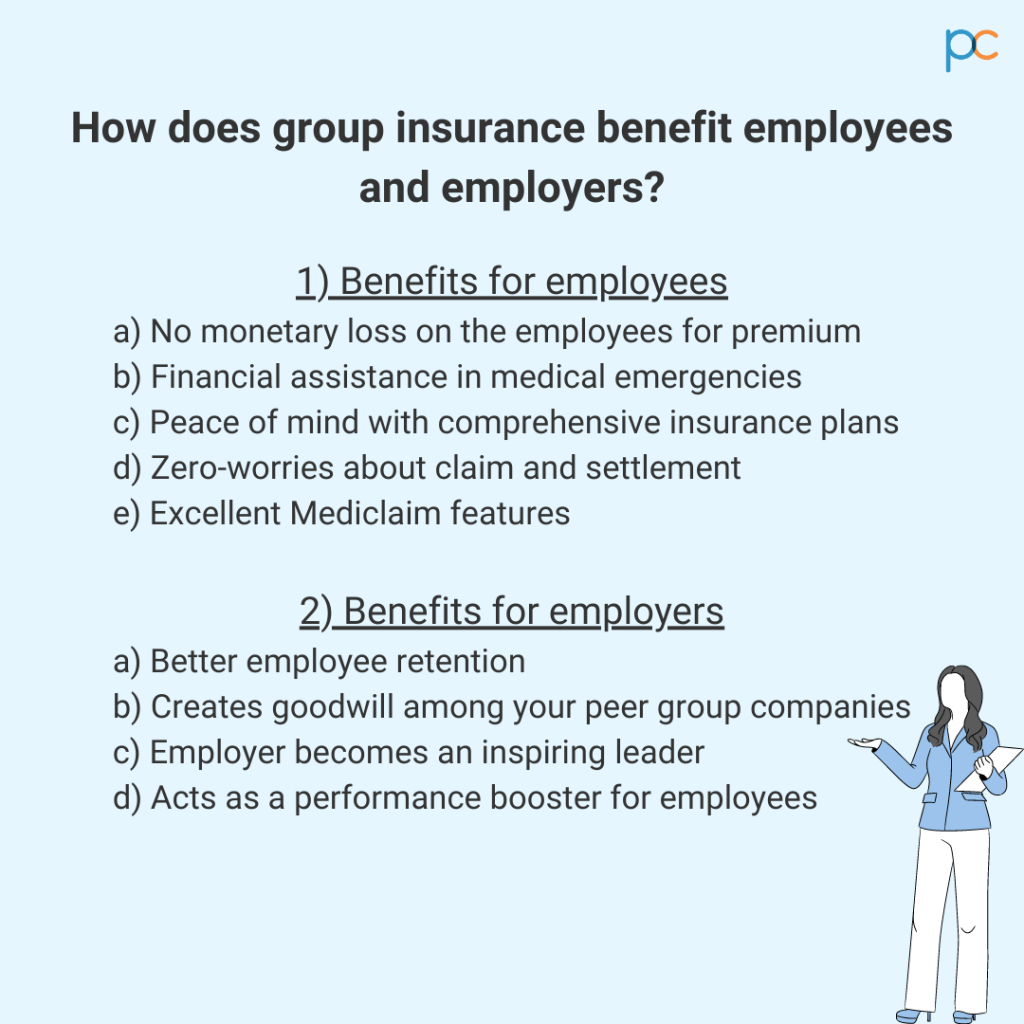

Benefits for for the employees

Employees have a larger share of benefits compared to employers. The employees and their dependent family members, including spouses, children, and, parents can enjoy medical treatment coverage through the policies. The employer is responsible for meeting the expenses of the insurance premium and, purchasing and you only have to serve in the organization to enjoy the perks. The following are the top five benefits from an employee’s perspective –

- No-load on the employees: The employees get medical treatment coverage in return for their service to the company. Whether the company is a small or large enterprise, the employer bears the cost of the premiums. Unless the employees are paying for the added benefits, the employer is the one to pay for the basic insurance premiums. Therefore, there is zero-load on the employees and, they can enjoy the advantages till their last day at service.

- Financial assistance in medical emergencies: Medical treatment under hospitals is expensive with the current inflation pace. So, treating a serious ailment at the hospital can drain all your savings. Having a group healthcare plan helps in releasing such financial stress. You get coverage based on the sum insured under your name and lighten the financial stress during medical emergencies. With cashless facilities and reimbursement options for treatment, it is valuable for any employee.

- Peace of mind with comprehensive insurance plans: Employer medical insurance can cover medical expenses for the dependent family members of the employee. If the employer picks a comprehensive Mediclaim insurance for the employees, the whole family can enjoy the plan coverage. Maternity coverage, childbirth expenses, accidental treatment, and much more get covered through the policies. Indeed, it brings mental peace as the employees can stay financially secure during medical emergencies.

- Zero-worries about claim and settlement: Employees can avail of cashless treatment with the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More under the vast network of hospitals. They only need to produce the Mediclaim documents and get hospitalized for valid medical reasons. It is a swift process and, the cashless approval takes less than an hour in most insurance companies. Even with reimbursement and claim, the procedure is hassle-free with a responsible TPA. Overall, the whole process is convenient for the policyholder(employee in this case).

- Excellent Mediclaim features and customizing scopes: Group health insurances cover pre-and post-hospital charges, surgery fees, doctor’s remuneration, diagnostic expenses, and much more. All these falls under the basic insurance coverage structure. If an employee wants to expand the coverage, they can opt for the add-on features. With the add-on benefits, the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More can customize the plan and, pay the extra premium for the added advantages.

Benefits for the employers

Who said that group healthcare policies only benefit employees? It is a wrong notion as employers can also gain a lot from the offerings. If you consider from a broader perspective, an employer can gain long-term goals through the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. The responsibility of bearing the expenses of the premium may appear as a loss on the employer’s part, but there are also advantages of the same. Read below to know more –

- Better employee retention: Most startups and organizations face difficulty in retaining employees for a longer tenure. Most employees leave the job for better packages and it hampers the overall production of the company. With service benefits like insurance policies, the retention rate is certain to improve. The employees grow loyal to the company and serve longer to continue getting the Mediclaim benefits. Think long-term to understand the broader profit from the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More purchase.

- Creates goodwill among your market-peers: Growing companies need hard work and support to expand. The support comes from the brand reputation and goodwill in the market. Group insurances are an excellent way of building your reputation. People identify the good aspects of your service offerings and thus show interest in joining your company. Use the group insuranceGroup Insurance is a type of insurance policy that covers multiple individuals under a single plan, typically provided by an More policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More to allure new talents to join the company and create a positive brand image.

- Enhances leadership qualities: An employer becomes an able leader when they consider the welfare of the workforce in the organization. Looking after the medical needs of the employees and finding a way to lighten their financial burden are excellent leadership traits. The employees consider the group Mediclaim benefits as a token of gratitude towards their service and respect you even more. Build a strong working unit with the best plan.

- A performance booster: If your company requires performance-boosting, there is no better option than the service grants. These are appreciative steps from an employer towards the employees and hugely motivate the employees to perform better. Grow the workforce productiveness with such service benefits that are genuinely helpful for the employees and their family members.

- An economic choice: Group health insurances have an affordable premium package. You do not have to pay much for the basic Mediclaim insurances. Also, employers can gain tax deductions through group insurances. By showing proof of premium payment from the employer’s side, they can reduce the tax burden at the year-end. Hence, offering the group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More is not only beneficial for the organization but also an economically-balanced choice.

PlanCover – Assisting in finding the right insurance

If you are an employer and thinking of purchasing group medical insurance for your employees, PlanCover is your ultimate guide. They have been consulting on group healthcare plans to employers of businesses, startups, and small to mid-capacity organizations. If your company has employee strength between 7 to 450, PlanCover is the best place to buy the insurance. Specify your requirements and they will fetch you a list of matching insurances from the leading IRDAI-approved insurance companies in India. Connect to their team to purchase the best policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.