Directors And Officers (D&O) Insurance PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More

Company in isolation does not make decisions. Board of directors, officers and key managers are empowered to make business decisions in the interest of the company to create and add shareholder value. Irrespective of their business acumen, and skills, their decision sometimes can result in financial losses. The directors and officers who made the decisions can be held personally liable and can be involved in costly litigation.

Directors and Officers insurance helps businesses in making decisions and not worrying about any such legal liabilities.

SMEs Misunderstanding of D&O Insurance

Small and Medium businesses often relate D&O insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More with publicly traded, large corporations. The fact that they are privately held and not listed makes them perceive that they are free from any such risk exposures. Not really!

- Law in India allows claimants to be indemnified for losses from a director’s personal assetsAssets refer to “all the available properties of every kind or possession of an insurance company that might be used More.

- SMEs have relationships with vendors, customers, venture capital funds, or other financial investors and employees. These are all external exposures for which their managers are accountable

- Directors and Officers of SMEs are also personally and legally liable for a business decision.

- Fire insurance or a General Liability policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More, which a SME purchase doesn’t respond to any legal liability on their managers.

- SMEs are also prone to Human resource issues with respective to sexual harassment, wrong termination are

- Lack of in-house legal team to manage any legal litigation on the company.

What is Directors and Officers Insurance PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More?

Directors and Officers (D&O) Insurance provides for financial protection for a manager, in the event of a claim against them, alleging a wrongful act in a managerial or supervisory role in the organization. D&O insurance pays for defense costs and financial losses resulting from this lawsuit.

“WRONGFUL” – – –

Generic meaning;

- Not legal, fair or moral

- Unwarranted, illegitimate etc.

- Having no legal claim.

In the Directors and Officers Insurance context, “WRONGFUL” means;

- any actual or alleged misrepresentation, misstatement, misleading statement, error, omission, defamation, negligence, breach of warrantyIn insurance, it is an undertaking by an insured person that something will, or will not, be done. More of authority or breach of duty means

Risks covered under D&O insurance?

Key exposures that make D&O insurance coverage necessary for the Directors and Officers are the following:

- Regulatory investigations.

- Accounting irregularities

- Exposures relating to mergers and acquisitions

- Vulnerability to shareholder/stakeholder claims:

- Securities claims, those related to shareholder value

- Employment practice violations:

- Sexual harassment, discrimination allegations and other employment practice violations including wrongful termination and failure to promote, negligent evaluation or unfair discipline, breach of employment contract, discrimination and harassment.

What does D&O insurance cover?

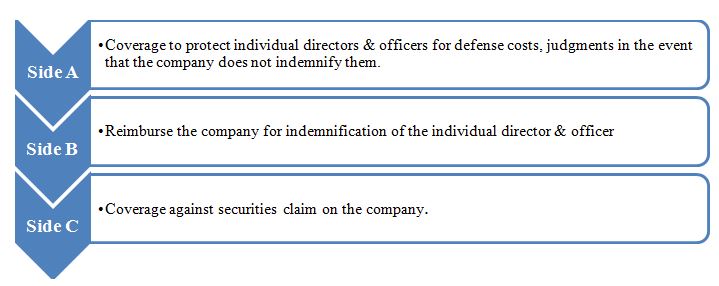

D&O insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More reimburses the financial loss arising as a result of a legal suit on individual directors & officers while discharging their fiduciary duties for the company. Broad coverage includes the following:

Unique Features:

- D&O insurance policies have retroactive date clause and provide coverage for wrongful acts that occurred any time back to the retroactive date, but not for acts that occurred before that date.

- D&O policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More is issued as a claims-made policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More that covers claims that are first made or reported during the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More period.

- There is also a Discovery period, the period immediately after expiry of the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More period, which is extended under this policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. This period can range depending on the scope of such period required and can be extended up to 12 months, upon payment of additional premium.

- Retired Directors and officers – Indemnify retired directors & officers for claims made against directors & officers.

Who can put a claim under D&O insurance?

- Directors and officers can be personally sued by an external stakeholder (shareholders, creditors, suppliers, customers, competitors or regulators) or by an internal stakeholder (board of directors, employees).

- Suits can be bought for various reasons. Shareholders might sue for insider trading. Creditors might sue for misrepresenting the financial health of the company. Competitors might sue for unfair trade practices.

Types of losses paid under a D&O insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More?

- Defense costs – Legal expenses and costs, which the company is legally liable to investigate, defend or appeal a claim. Defense costs also include Bail bond and civil bond expenses.

- Public Relations expenses – Costs incurred to retain a public relations consultant to reduce or prevent negative publicity.

- Extradition costs – Costs to have a legal adviser or tax consultant towards advice on extradition proceedings.

- Emergency costs advancement – In the event of defense costs trigger, the company can also request for payment of defense costs on retrospective basis.

How the limits under D&O insurance work?

- Coverage will be restricted by policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More terms and conditions, and limited within a certain maximum limit of coverage.

- The limit varies depending on the company’s revenues, business, and exposure type.

- The policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More limit is an “annual aggregate”, meaning that there is only one single limit for all the claims during one policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More year.

- Defense and other costs are part of this single limit.

Important exclusionsExclusions in insurance refer to specific conditions, treatments, or circumstances that are not covered under a policy. These exclusions define More

- Dishonest or Improper conduct – any willful breach, fraudulent or malicious act, willful violation of obligation, contract or regulation,

- Knowledge of prior matters and notifications.

- Legal action already taken prior to policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More inception.

- Bodily injury, sickness, mental anguish or emotional distress, diseases or death of any person and damage to tangible property.

- Claims made under a previous policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

Regulatory changes have also improved scope for D&O insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

- The new Companies Act, 2013 in the country comprehensively focuses on fraud risk management.

- Penalties for directors and officers of a company.

- Directors can obtain indemnities from the company. Under the erstwhile Companies Act 1956, companies were constrained to provide such indemnification.

- The act also implicitly recognizes the right of the company to obtain D&O insurance policies by paying premium.

Why Us?

- Professional advice and consulting approach.

- Customise coverage and limits.

- Access to Top Insurance players.

- Best premium services.