Non-life insurances are of many types. There are group healthcare policies, accidental insurances, and many more. Among the various non-life insurance plans, the two most commonly confused ones are – Mediclaim policies and accidentAn accident refers to an unforeseen, unintentional, and unexpected event that occurs suddenly and results in injury, damage, or loss. More insurances. Whether you have an internal ailment or face an accidentAn accident refers to an unforeseen, unintentional, and unexpected event that occurs suddenly and results in injury, damage, or loss. More, you need to get hospitalized for treatment. In such times, these insurances provide financial support by bearing the expenses or providing compensation. But there are significant differences between the two policies and their working ways. The group Mediclaim coverage is applicable for medical treatment of all kinds (barring the exceptions). In contrast, the accidentAn accident refers to an unforeseen, unintentional, and unexpected event that occurs suddenly and results in injury, damage, or loss. More coverage is only applicable if you have met an accidentAn accident refers to an unforeseen, unintentional, and unexpected event that occurs suddenly and results in injury, damage, or loss. More and sudden injuries leading to physical disabilities.

Table of Contents

Understanding both policies

As both the policies fall under the “group insuranceGroup Insurance is a type of insurance policy that covers multiple individuals under a single plan, typically provided by an More” category, many do not understand the concepts clearly. A group medical insurance is the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More given by the employer of an organization to their employees. The employer pays the renewal premiums and other charges to continue the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More coverage. Under the insurance plan, the employee can get restitution for treatment expenses to the insurance company on getting hospitalized for a medical issue.

In the group personal accidentAn accident refers to an unforeseen, unintentional, and unexpected event that occurs suddenly and results in injury, damage, or loss. More policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More, the employer buys the insurance for the employees working in the company. Unlike the Mediclaim policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More, here the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More (employee) only gets financial coverage on facing any serious accidental injury or receives a death compensation. Here also, the employer pays the annual renewal charges to continue the plan benefits.

Points that differentiate

If you consider the plan features, there can be many differences. The features depend on the particular insurance company that your employer has picked. The elementary difference is the coverage aspects and who gets the insurance benefits. Read along to know more differences-

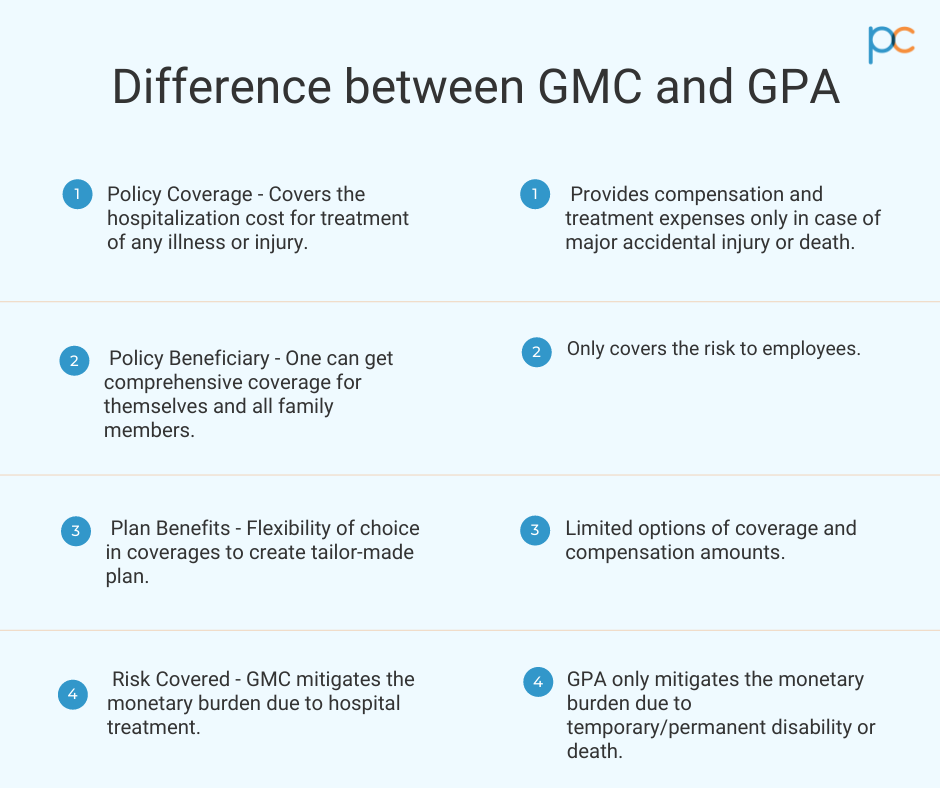

- PolicyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More beneficiary: In a group medical insurance, the plan coverage can be comprehensive, where the employer chooses to include the dependent family members in the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More beneficiary list. The choice of offering insurance coverage to the family members in the Mediclaim insurance depends on the employer. They can also pick a group Mediclaim that only covers the employee and not their spouse or children. In contrast, the group personal accidentAn accident refers to an unforeseen, unintentional, and unexpected event that occurs suddenly and results in injury, damage, or loss. More policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More can be beneficial for the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More only (employee in this case). The employee is the only eligible one to claim the insurance for any major accidental injury. If the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More dies of a fatal accidentAn accident refers to an unforeseen, unintentional, and unexpected event that occurs suddenly and results in injury, damage, or loss. More, the nominee gets compensation.

- Plan coverage: Both insurances aim at offering treatment expense coverage but, the reasons are different. For group Mediclaim policies, the general coverage norms include insurance claim provisions for emergency and critical medical treatment procedures at hospitals. There are provisions for cashless treatment and planned medical treatment with reimbursement facilities in the group healthcare plan. With the group personal accidentAn accident refers to an unforeseen, unintentional, and unexpected event that occurs suddenly and results in injury, damage, or loss. More coverage plan, the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More can only claim compensation and treatment expenses, due to physical injuries and accidents.

- Plan restrictions: Both insurance policies have a few coverage exclusionsExclusions in insurance refer to specific conditions, treatments, or circumstances that are not covered under a policy. These exclusions define More. The excluded aspects as different for the type of policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. In the group healthcare plan, the exclusionsExclusions in insurance refer to specific conditions, treatments, or circumstances that are not covered under a policy. These exclusions define More are related to diseases and their treatment expenses. There are some predefined regulations by IRDAI that enlists the excluded treatment from Mediclaim coverage. (example – cosmetic surgery, regular health checkups, dental surgery, infertility treatment, etc.) In the case of the accidental group policies, the restrictions are related to the different accidental injuries. Depending on the physical impact due to the accidentAn accident refers to an unforeseen, unintentional, and unexpected event that occurs suddenly and results in injury, damage, or loss. More, the insurance coverage gets decided as per the defined policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More norms of the associated insurance company.

- Plan benefits: With group Mediclaim insurance, the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More (and their family members, if included) can get a cashless treatment facility under the network of hospitals in India. They can also claim reimbursement of pre-and post-hospitalization expenses from the insurance company. Barring a few expenses, almost every medical treatment gets covered under the claim reimbursement and cashless provisions. For group personal accidentAn accident refers to an unforeseen, unintentional, and unexpected event that occurs suddenly and results in injury, damage, or loss. More insurance, you can get personal injury treatment expenses (unintentional injuries) and death compensation. The compensation amounts and percentage differ with the physical impact like – loss of limb, loss of eyes, temporary physical disabilities, major burns, etc. The nominee gets compensation for the accidental death of the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More.

- Waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More: The waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More is the span (varies with insurance company norms) during which the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More cannot claim treatment expense for certain critical and pre-existing ailments. It is a common rule across all group health insurance programs. The policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More can get cashless coverage or reimbursement only after completing a certain defined waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More. In the case of group personal accidentAn accident refers to an unforeseen, unintentional, and unexpected event that occurs suddenly and results in injury, damage, or loss. More insurance, there is no such waiting span. You can get policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More benefits after the plan approval. However, the approval time may vary depending on the insurance company, but in any way, the span is lesser than Mediclaim.

Which is a better plan?

When you consider the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More coverage features of these two non-life insurances, the choice becomes clear. In fact, in some of the group Mediclaim policies, there is also medical treatment coverage for accidental injuries. So, with group healthcare plans, you get compact coverage for yourself and maybe your family members too! An accidentAn accident refers to an unforeseen, unintentional, and unexpected event that occurs suddenly and results in injury, damage, or loss. More policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More only takes care of accidental injuries and sudden mishaps which may not be wise non-life insurance to pay for. Unless your job requires you to visit places prone to accidents or indulge in life-risking activities, a group healthcare plan is always the more sensible choice.

What should the employer purchase?

As an employer, you have to understand what your employees require. Usually, an employee would always prefer a healthcare plan for themselves and their family members. It is also profitable on the employer’s part if they go for a group Mediclaim. Following are the top three advantages of buying a healthcare plan for your employees.

- Affordable premiums with extensive plan coverage

- Get tax benefits with group healthcare plans

- Motivate employees and improve employee retention in the organization.

How can you buy the insurance?

You can select the group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More among the many options available in the market. Connect to the sales representative of the insurance company to buy the healthcare plan that you have selected. Another way to purchase insurance is by finding an insurance broker. Insurance brokers offer more than one policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More from the reputed insurance companies in India. You can select any policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More from the several options, as per your expectations and budget and, ease the process.

Resolve the needs with PlanCover

The reputed insurance-broker company, PlanCover helps employers from small to mid-capacity companies to buy group healthcare policies. If your organization has 7 to 450 employees, PlanCover is your one-stop solution for purchasing the group Mediclaim. They offer the best group medical insurances from the leading IRDAI-approved insurance companies in India. Get in touch with the experienced team of PlanCover and buy the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More that suits your needs.