Table of Contents

A Comparison Between ESI And Group Mediclaim Policy

Almost every workplace organization or business offers employee health benefits to retain the resources and ensure employee welfare. ESI and group insurances are the two most common options that you can find. Which one is right for your medical necessities?

Many are well aware of a personal Mediclaim but are unsure about ESI or group plans. ESI and group healthcare plans are for employees working in an organization. In the case of group healthcare insurance, the employer pays the premium for the employees so they can enjoy insurance coverage and associated benefits. In ESI, the employees can get medical reimbursement on paying the coverage premium. The employer and employee both pay the premium charges, unlike group insuranceGroup Insurance is a type of insurance policy that covers multiple individuals under a single plan, typically provided by an More, where the employees need not pay anything extra. Read the following to understand how these two are different service benefits with similar interests for the employees. It will help in deciding which one is a better choice for you.

Understanding ESI – Employees State Insurance

Employee State Insurance or ESI is a scheme for employees serving in an organization to get medical expense coverage. The ESI program gets regulated through the labor welfare organization, ESIC. It is under the Ministry of Labor and Employment, an autonomous and self-financed body. The elementary objective of this scheme is to provide financial support to employees in sickness and death.

What is the ESI Act, 1948?

The Employees’ State Insurance Act, 1948 or the ESI act is a parliamentary act, the first of its kind in India post-independence. As per this act, the employees working in factories, organizations, and business establishments can qualify for enjoying the medical benefits. Employees can avail of the medical expense reimbursement during their service period. In unfortunate cases of untimely death, the dependent family members of the deceased employee will also receive certain benefits from the scheme.

Understanding group health insurance

Employer health insurance or group health insurance is a healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More that the employer offers to the employees as a service benefit. The employer purchases the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More and pays a premium for annual renewal. The employees and their dependent family members (spouse, children, parents) enjoy the insurance coverage under the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More norms. The employees usually do not have to contribute any amount from their salary and, the employer takes complete responsibility.

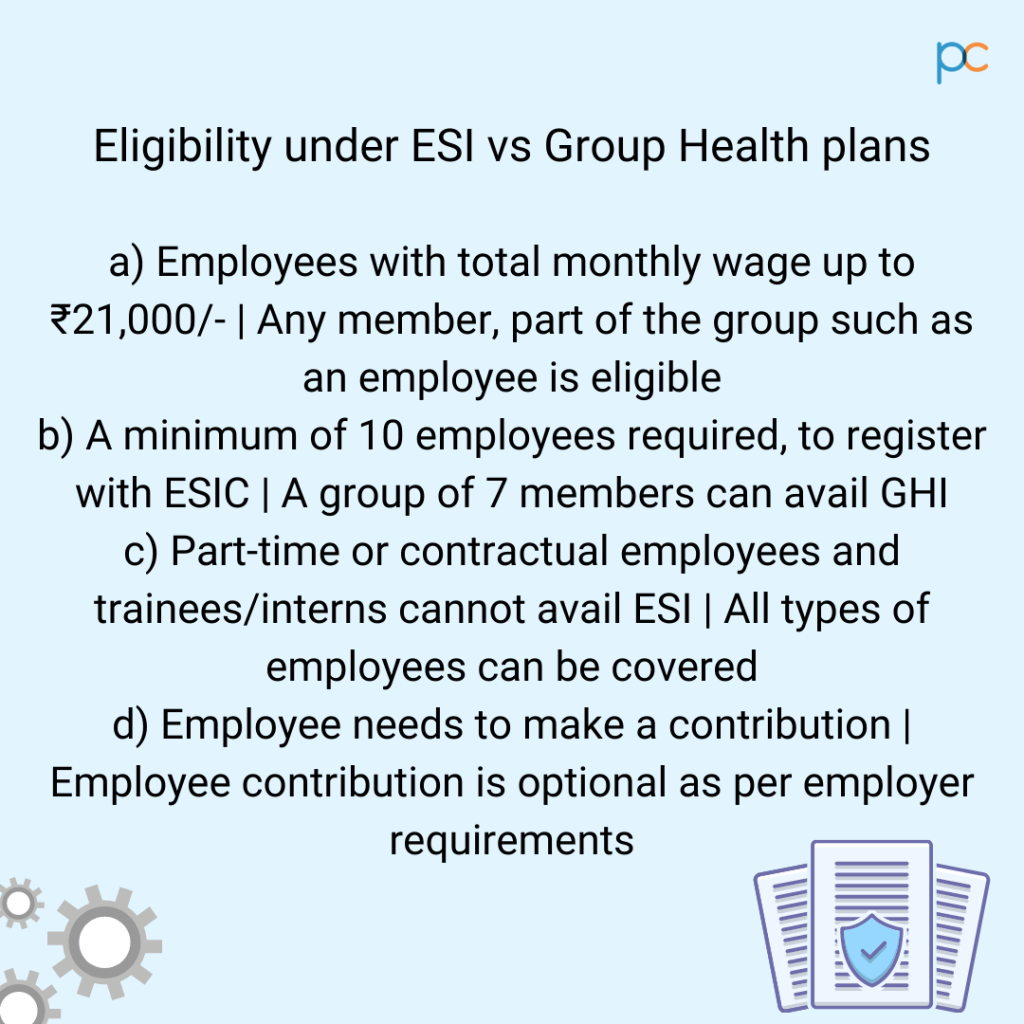

Comparing eligibility norms

As you can see, both ESI and group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More are for employees working under an organization. But there are differences between these two for the offerings and features. Start with the eligibility regulations to understand the key differences.

- Under ESI, an employee can qualify for the benefits if the monthly salary is less than Rs. 21,000. If the employer under whom they are working has registered with ESIC, the employee can get the ESI benefits. The organization of the factory where they work should have a minimum employee strength of 10 to be eligible for registering.

- Under group health insurance policies, any employer having an organization with seven or more employees can buy the insurance for the employees. The group policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More need not be for an employee-employer group. It can be any association or group where the interest is singular among all the members.

Essential documents in both the cases

Any business or organization wanting to register for the ESIC benefits should provide the following documents – Registration certificates for shops, partnership deeds (if any), Details of employees ( compensation details, legally accepted ID proofs, PAN cards, etc.), employee attendance register, a cancelled cheque of a bank account under the company’s name, list of shareholders.

For group health insurance purchase and approval, the employer should connect to the insurance company and specify the requirements. The employer can pick the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More they want and provide employee data and the GST number of the company to purchase the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. Depending on the insurance company you have chosen, the document requirements may vary. However, the documental formalities are less for buying group healthcare plans.

Check out the contribution rules.

ESI and group healthcare policies are a part of service benefits conferred to the employees from the employer or organization. But the contribution patterns are different in both cases. In an ESI scheme, the employee and employer have to contribute to the insurance. The employer pays 3.25 % of the payable wages and, the employee contributes 0.75% of the salary for availing of the ESI benefits. **

In contrast, for group insurances, the employee need not pay anything for the premium. The employer pays the premium and renews it annually. However, it depends on the organization norms to determine the contribution factor. In most workplaces, the employer pays off the premium. But, in some organizations, the employees contribute a portion of their salary for the premium payment.

Comparing Group Health Insurance and ESI

Choosing any one of the two can be a tricky part for employees. By comparing the features and benefits of the insurance schemes, you may get a better idea. It brings clarity so you can decide based on your requirements and preferences. Read along to know the determining factors essential for your selection.

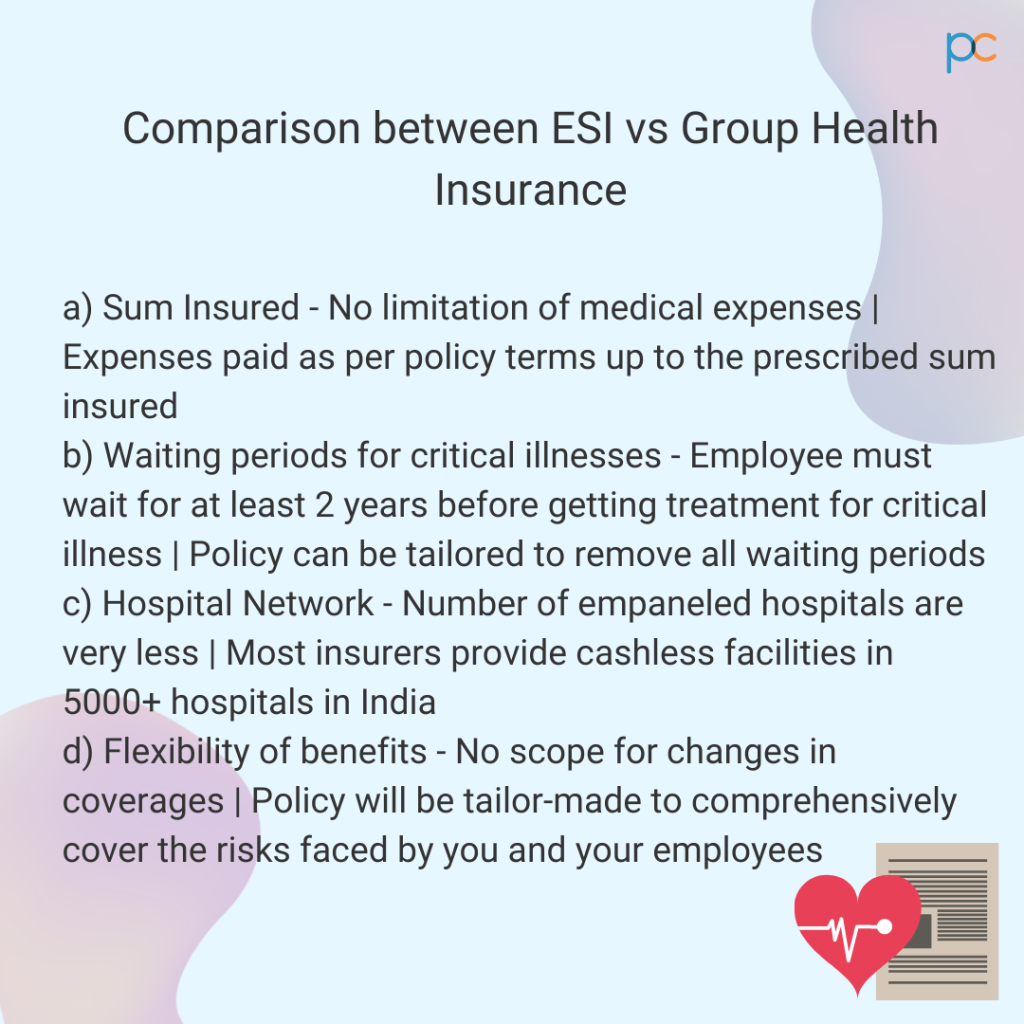

- Sum assured: In a group health insurance plan, there is an amount that gets insured for the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More. The employer decides the insured sum as they pay the premium. There is a limitation to bearing the medical expenses in a group insuranceGroup Insurance is a type of insurance policy that covers multiple individuals under a single plan, typically provided by an More policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. With ESI, there are no such limitations. There is no fixed sum that gets insured for the employee.

- Cashless coverage: With cashless medical coverage, the employee can get hospitalized and treatment without spending a penny. It can happen only in the hospitals under the approved network of the insurance company. In a group healthcare plan, the network of hospitals is huge ( 5000+ hospitals on average, all across India). While in ESI, the number of approved hospitals is lesser. In both the insurances you can get cashless hospitalization and treatment, but the options are less in ESI.

- Critical illnesses and waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More: The waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More for critical illnesses and pre-existing diseases is a troublesome concept. The waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More is the tenure during which the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More does not get any medical benefit from the insurance provider. In group health policies, the waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More for treatment coverage of critical illnesses can vary. Some insurance companies have a 24months waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More, while some may not have any. In ESI, the time is fixed. The employee has to contribute for at least 2years to get reimbursement for critical ailment treatments.

- Maternity coverage: In the case of ESI, if any female employee gets enrolled for 70days or more than for two consecutive contributory terms (Apr-Sep & Oct-Mar) then she gets eligible for 26 weeks salary for confinement and 6 weeks for miscarriage, during the maternity leave. This is a unique feature of ESI but is inapplicable for group healthcare insurances. In a GHI, the female employee or the wife of a male employee gets medical expense coverage for delivery and pre-and post-hospitalization costs.

- Job switch: In both insurances, you can continue getting the benefits after a job change. The procedures and norms are different but, it is possible. In group health insurance, you can port the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More to an individual plan to continue getting the medical benefits. While in ESI, you have to change the employer’s name through legal ways.

- Death or disability benefits: There are no death or disability benefits in group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. The group insuranceGroup Insurance is a type of insurance policy that covers multiple individuals under a single plan, typically provided by an More is valid till you serve the organization and continue to pay the premium for renewal. It does not cover any expense other than medical treatments. In ESI, the employee can get a pension (up to 90% of the last salary amount) if there is an unfortunate accidentAn accident refers to an unforeseen, unintentional, and unexpected event that occurs suddenly and results in injury, damage, or loss. More that causes permanent disability during service tenure. In case of death during the service period, the family will get a pension from the ESI fund.

- The flexibility of benefits: In group healthcare plans, the scope of adding Mediclaim features is more. Many insurance companies allow the policyholders to buy add-onsAdd-ons, also known as riders or optional covers, are additional benefits that can be purchased along with a standard insurance More for better coverage flexibility and convenience. In ESI, you cannot alter the sum insured or make any changes to the available benefits.

- Hospital network: Hospital network is better and wider in group health insurance plans. Most insurance companies have 5000+ hospitals in their network all-through India. While in ESI, the cashless hospitals are not too many. There are only about 154 ESI hospitals across India. So you can notice the drastic difference in the numbers.

Reasons to choose Group health insurance over ESIC.

- Free healthcare options: In a group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More, the employer pays the premium while an employee can enjoy free benefits. In ESI, both have to contribute to availing of the medical coverage. So, a GHI is a better choice considering this angle.

- Easy claim settlement and cashless treatment: ESI hospitals are under the Government of India and, so are the ESI offices. The efficiency of the ESI department is lesser than the of private insurance companies. In GHI, you can claim through a TPA and expect claim settlement in 7 to 30 days. While in ESI, the time can be much more. Also, with cashless treatment, GHI is better for the huge network of hospitals as ESI only has a few options to go to.

PlanCover – The right choice

PlanCover, a top-rated insurance selling company in India, brings the best group health insurance plans for employers having a small to medium enterprise. They offer the best insurance plans to organizations having 7 to 450 employees. By connecting to the team of PlanCover, you can review the insurance offers from the leading IRDAI-approved insurance companies in India. Reach out to their team and buy the best healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More for employees working under you.