Table of Contents

Overview of Covid Group Mediclaim Policy Plans

With the pandemic outbreak, there was a sudden change in the usual way of life. The regular schedule, health facilities, freedom of stepping out, and everything which was a part of the typical “normal” is no more “normal”. The whole world is adjusting to the norms of the “new normal” in every possible way. In this scenario, having the right resources to manage the expenses for Covid treatment is highly essential. But not everyone has sufficient financial backup to meet the necessary expenses related to Covid treatment. In such times having the support of a healthcare plan acts as a boon.

Rising need for health insurance

Healthcare plans are indispensable as your insurance is the only support left when you face medical emergencies. You can get admitted to the hospitals without paying a single penny for the cashless benefits. Group health insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More, provided by an employer to the employees, helps support the financial necessities during medical treatment. The treatment for Covid is expensive and, you need to stay financially prepared to meet the needs during the treatment.

None of the health insurance companies offered coverage for Covid treatment as the term “coronavirus” came into existence during early 2020. Thus, anyone having a healthcare plan (group or personal) now needs Covid treatment coverage. Those buying insurance for the first time can go for a comprehensive corona-care group health insurance plan. Those who already have an existing group healthcare plan (or a personal health insurance policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More) can buy the add-on corona-care schemes to meet the needs.

At least 24.34 lacs claim for covid-19 treatment was filed during the period between March,2020 to September 2021. The cumulative claim amount was reported around Rs 30,806 crore by IRDAI. Till date, about 85% of those claims have been settled. The average insurance claim was Rs. 97,302 for covid-19 treatment. **

What is a Covid group healthcare insurance?

Group healthcare plans are always of great help to employees. It is a service benefit that they earn by working under an organization. The employer buys the group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More and pays the premium on the employee and their family’s behalf. With covid group healthcare plans, the benefits are more. You get complete treatment coverage without any worries at the best hospitals in India. It acts as a financial relief and provides peace of mind during such distressful times when the world is down with the virus outbreak. You get complete treatment coverage for hospitalization through cashless benefits or reimbursement. Both ways, it is the employees who can enjoy the perks.

Reasons to get a Covid group healthcare plan.

Even if you own an individual healthcare plan, group health insurance always turns out advantageous. A covid group Mediclaim plan brings benefits to the existing healthcare coverage limits. You may not get Covid treatment coverage with your current insurance but, with the new covid group Mediclaim policies, you do not have to spend a penny. It covers the medical expenses necessary for Covid treatment under medical guidance.

- Uncertainty with medical facilities: It was hard to find a bed in most hospitals during the pandemic. Even if you needed to get hospitalized for a disease that was not related to coronavirus, the process was very troublesome. Those getting affected with coronavirus faced a hard time because not every hospital had the facilities to support the medical needs. Thus, having a covid-protection healthcare plan helps you get admission at the covid-special hospitals during emergencies.

- Financial support during tough times: A cashless treatment coverage saves a lot of stress in a medical emergency. The treatment cost in the hospitals for corona care is high. You need a lumpsum financial backup to support your needs. Especially for patients with co-morbidity, the expenditure gets doubled for the different treatment methods and health support setup. Thus, having group healthcare where the employer pays the premium so you can enjoy corona-care coverage is nothing less than a blessing. Even if you have to pay a portion of your salary for availing of the extra medical coverage for corona protection, it is in no way a bad deal for you.

- A way to deduct tax: Coming to the employers, what benefit can they enjoy by providing the Covid group Mediclaim policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More to their employees? Yes, they also can enjoy the perks of buying the policies and paying the premium charges. The employers can avail of tax deductions at the year-end by producing valid documents that prove premium payment on behalf of employees. The pandemic has also stalled the economy for which businesses and organizations are not earning as much profit as they used to. In such times, having a tax deduction truly helps in more than one way.

Features to look for

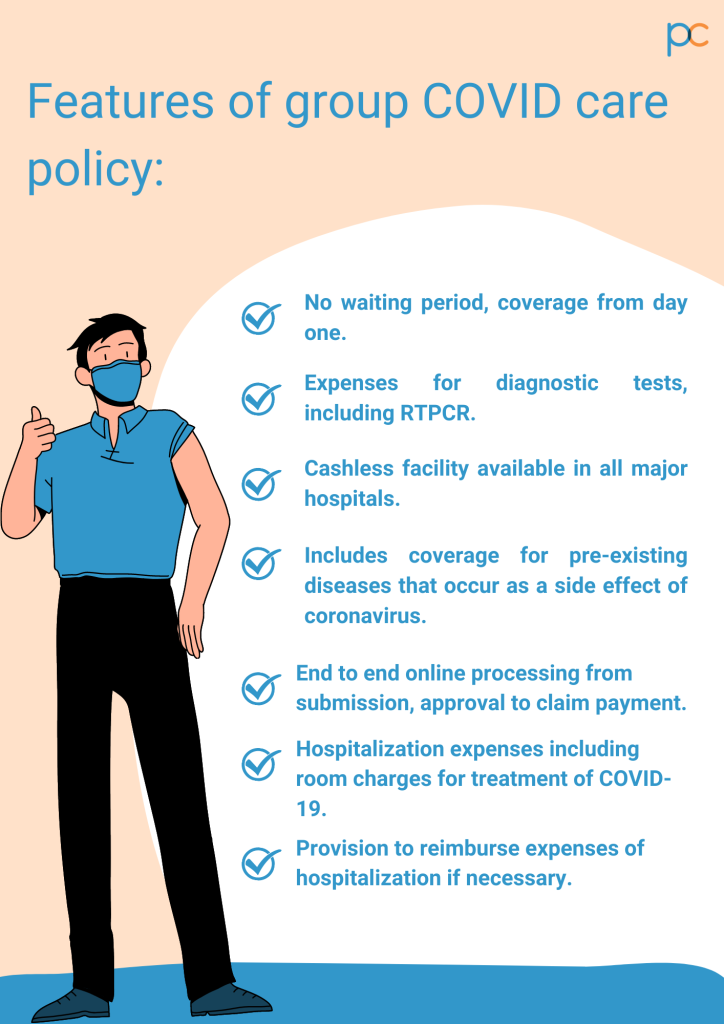

Are you looking for a suitable policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More to buy? But how do you know if it is the right plan to cover the covid expenses. There are multiple options available, with so many insurance companies in India. But not all of them offer similar plan features or are as useful as you expect them to be. Thus, before purchasing the plan for your employees, check through the necessary features of a Covid group Mediclaim so you can identify the best from the rest.

Is there a waiting period?

The waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More in health insurance refers to the term when you cannot enjoy the treatment coverage for a particular disease. For planned treatments like orthopedic surgeries or others, you can plan the treatment course as per the waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More tenure to enjoy the perks. But what about emergencies? The treatment for corona cannot wait. You have to go for a policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More that offers Covid treatment coverage from Day-1 to make the most of the plans.

Is the processing online?

As a result of the lockdown, everything has shifted online. Hence, the Mediclaim processing also needs to get done virtually. It is not possible for the policyholders to go for a medical checkup for policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More approval amidst such restrictions. It is also unsafe for the health. Thus, the group policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More you choose has to offer the insurance through online processing and complete the approval procedure within a span of 7 days.

Can you get a cashless service?

Not everyone may be in the position to pay the costly medical bills during the Covid treatment. With an instant cashless medical facility, they can carry out the treatment without worries. Also, reimbursing the claim during the lockdown period is highly troublesome. All these reasons make the cashless treatment facility a must for the policyholders. Ensure that the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More you pick for your employees has cashless treatment coverage over a large network of hospitals that provides the covid-care treatment.

Expenses for online doctor consultation

With the pandemic outbreak, many doctors are now seeing their patients through virtual consultations. You no longer have to visit the doctor’s chamber or clinic. The payment and consultation, everything happens online. But not all Mediclaim policies offer expense coverage for online treatments and prescriptions. It is vital for a group healthcare plan to provide this facility as the online doctor consultation is gradually becoming a part of the new-normal regulations.

Expenses for diagnosis

Many healthcare plans do not provide pre-hospitalization treatment coverage for Covid patients. But there are different pathological and diagnostic tests that require insurance support. Whether it is the RTPCR (reverse transcription-polymerase chain reaction) test or other blood tests, the healthcare plan should offer complete expense coverage for the pre-hospitalization costs.

What about critical illnesses?

Sometimes a corona-positive patient may also have pre-existing diseases that worsened for the virus attack. The pre-existing diseases may be cardiac-related, lung infections, kidney damages, and many more. Alongside corona treatment, the patients also need medical support for treating the side effects that arise due to the ailments. Many insurances do not offer such compact coverage and only pay for the corona-care expenses as a part of the corona-protection Mediclaim. Ensure that your group plan provides complete coverage so that the policyholderA policyholder is an individual or entity that owns an insurance policy and pays the premium in exchange for coverage. More can stay worry-free.

What about home hospitalization?

A corona-positive patient may not require hospital-based treatment. In many cases, doctors prescribe home-care with medical support to help in recovery. A covid group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More should offer complete or partial expense coverage through reimbursement in such cases. Before purchasing the insurance, you can consult with the insurance company representative to find such flexible treatment coverage packages. Buy the one that suits the needs of the patient and is convenient in every way.

Check the premium rates

Group healthcare insurance can be for the employee and for their family members also. But the decision is on the buyer (employer in this case) whether they can bear the premium charges for the comprehensive Mediclaim policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. However, it is always better to buy the comprehensive covid care group policies for the benefit of the policyholders. You can check the premium rates to decide the affordability limit or can ask your employees to contribute a part to avail of the beneficial coverage aspects.

The best way to find the insurance policy

How do you find insurance that features all the discussed advantages? You can research and find out the right policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More by reviewing the insurance plans from the leading companies. Or, you can take a wiser step by connecting to an insurance broker. Specify your budget and expectations from the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More and, the broker will provide you with the best plans. You can review the alternatives provided by them to select the best.

Get what you want, with PlanCover.

PlanCover is a leading insurance-selling company that sells group health policies to employers and founders of organizations and businesses. They offer the best Covid group Mediclaim policies from the top insurance companies across India from the list of IRDAI-approved names in the business. You can reach out to their team with your estimate and specifications and they will manage the rest to fetch you the most suited deal.