The health tech industry is among the most essential services in India. The jobs in health tech companies may include online delivery of medicines to a virtual doctor appointment. The job roles are different with the different companies but, the urgency of service is equal throughout all the companies and startups. Health tech startups have been on a rise since the last decade.

In fact, the covid situation and lockdown restrictions all around the country have led to an increase in the number of health tech startups in the country. Like all other organizations, the health tech sectors need to cater service benefits to the employees. Know the indispensable features in a group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More that makes it a perfect choice for purchasing by the health tech startup founders.

Table of Contents

Scope of health tech expansion

As per international research and studies, the addition of artificial intelligence in the healthcare industry is the reason behind the growth of the numerous health tech startups in India. The use of AI has facilitated health services largely and eased the needs of the customer. With Covid-19 and pandemic effects, these health tech startup services have been more useful than ever before. The use of technology and artificial intelligence in the healthcare sector is anticipated to reach more heights in the near future.

More investors are coming on board with more investment amounts for the various scopes in the health tech industries like – e-pharmacy services, tele doctor consultation, virtual health management, and much more. As the scopes are humongous, reports claim that the health tech industry will increase by $50 billion by 2023, and by 2033 it will rise to $50 billion. In 2020, the e-pharmacies earned huge revenue and are still making newer records. **

Role of group medical insurance in it

A startup that focuses on a growing industry (health tech in this case) needs a steady plan to structure its growth. There is no better tool than the employees to build a startup from a scratch. Your workforce helps you succeed in the competition with their expertise and efforts. So, it is vital to retain your employee base and get new able employees with the existing team.

A group healthcare plan can be highly useful for health tech startups. How? The employer or group Mediclaim plan is a service-related benefit that the startup founder or the organization’s employer provides to their employees. The employer pays the premium charges for renewal and the employees can enjoy plan coverage till the last day of their service at the company.

Best features to note

Group healthcare programs have distinct features and plan benefits with different insurance companies. As the employer purchases the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More for their employees, picking an industry-specific insurance plan helps cover the needs of the employees working in the company. Get an overall idea of the essential plan features to purchase the best group healthcare plan for the employees.

- Hassle-free plan coverage

An efficiently functioning insurance company eases the requirements of the policyholders during medical treatments. Whether it is claiming the expense or getting add-on features to your existing group policies, the efficiency of the associated insurance company matters the most. Check for the online reputation of the company to get an idea about its functioning and efficiency. E-claims, in-house claim settlement, dedicated customer assistance, and other such customer-oriented services are an important part of the group policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

- Flexible plan extensions

Health tech startups are making a profit these days; thus, the employees also enjoy a decent income. In many organizations, the employees are unable to pay for the add-on benefits of group healthcare. The add-on features help in making the insurance terms flexible, by including plan coverage for specific diseases. (like – corona care, diabetes care, hypertension treatment, specific ailment coverage, etc.)

The employees can maintain the extra expense for which, providing them a regular and basic insurance plan may not be too fruitful for their use. As an employer, you should give them the scope to customize the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More benefits. Check for a group healthcare plan having options to add-on features and extend the sum.

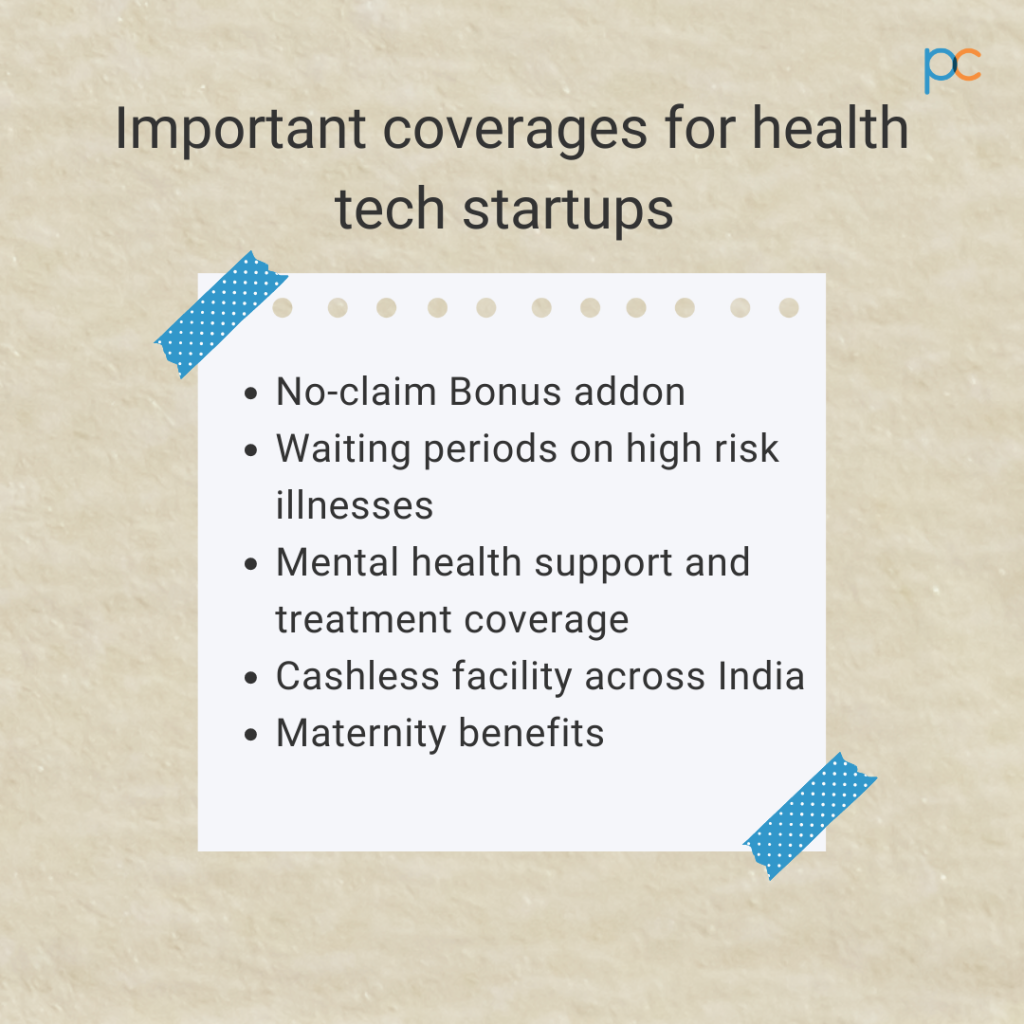

- No-claim bonus and overall wellness

Most employees working in health tech startups have an average age below thirty-five. With employees belonging in the lower age band, the probability of them falling ill and claiming insurance is less. However, the group dynamics can vary with the startups. But mostly, it is noticeable that employees do not belong to the upper age group (over forty-five).

So, purchasing a group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More that provides discounts at year-end for no-claims throughout the year is a beneficial aspect for employers and startup founders. Why? Because they are the ones paying for the yearly renewal of insurance policies. So, a cut in the overall price is always a good thing to have.

- Comprehensive Mediclaim coverage

There are plenty of opportunities in the job market for an experienced professional in the health tech industry. Getting better jobs is easier for an able employee. So, startups have to keep their valuable resources (employees) in the company to ensure better business growth.

Offer a comprehensive group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More to the employees where the dependent family members of the employees can also enjoy policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More coverage. With such lucrative benefits, the employees do not usually consider switching jobs, and thus, you can gain long-term benefits! Also, ensure that the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More provides the following benefits –

- Pre-and post-hospitalization expense coverage

- Daycare expenses

- Critical ailment coverage (for senior citizen parents)

- Pre-existing ailment coverage

- Maternity and childbirth coverage

- Low waiting periodA waiting period in insurance refers to the time frame during which a policyholder must wait before certain benefits become More for disease coverage and pre-existing diseases

- Cashless treatment facilities across leading hospitals in India

A policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More that meets the needs

Health tech startup founders need to find a policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More that meets the medical requirements of the employees. The group policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More should help them eliminate the financial stress during expensive treatment at the hospital. But where can you find a policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More that specifically helps the employees belonging to the health tech sector?

You can connect to the insurance company to find suitable options. But it restricts your options as you only get to browse the policies of a single insurance company. It is good to approach an insurance broker to specify the features you need with the group healthcare plan and purchase it at the best price.

Find the ideal policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More with PlanCover.

The most reliable insurance broker, PlanCover brings the right plans to help employers and startup founders. With them, you can find customizable and basic group healthcare plans for small to mid-scale organizations. They offer insurance from IRDAI-approved companies at the best price. Connect to them and get the ideal policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More that meets the requirements of the health tech employees.