Among the newly established professional fields in India, EdTech is currently the most popular one. Each day you can notice a new name in the business. Startups are growing based on the innovative functioning of education and technology. In fact, the advent of Covid has also played a significant role in establishing the strong game of the EdTech startups in India. Hence, it is no longer an out-of-the-box profession for many. Young tutors and technology experts are joining the industry to bring better ways to cater to the customers of this professional field. Thus, the startup owners have to find an effective way to retain the talented workforce and get new talents on their team by offering genuine service benefits, like group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

The future is brighter than ever

The combination of technology and education has been the incepting idea behind the numerous EdTech startups in India. The unicorns in the EdTech industries in India have paved a way for the new and ever-growing startups in the business. Currently, about 80% of students who are still in their pre-primaries are aware of the online study courses. The industry that started gaining pace in 2019 is about to grow 5x by the end of 2022. **

Online education popularity is expected to encourage more investors in the business. Thus, startups, trying hard to establish their business, need to buckle up and strengthen their resources to sustain the upcoming competition.

- Bringing new talents onboard: Employees are the pillar of any workspace or professional field. An organization needs to focus on two things. Get new employees onboard and retain the existing team. None of these is possible if the organization’s management does not care about the employee’s needs and provides them with service benefits. Group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More works like a charm for attaining the best workforce for your business. Especially in EdTech startups, the need for getting able employees like educators, moderators, and coders is a must. Otherwise, you will fail to take advantage of the booming industrial prospects.

The best group healthcare plan features

A group healthcare insurance is a service benefit offered by the employers in the organization to their employees. The employer buys the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More and pays the premium every year to continue the insurance coverage. The employees get to avail themselves of the insurance coverage and other medical benefits till they serve the company or startup. So, as an employer, you have to ensure that the insurance you provide to your workforce brings a return that suits your interest. Read the following to understand what features in a group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More make it a suitable one for the employees working in the EdTech startups.

- Overall health and psychological well-being

What is the role of the employees working in the EdTech industry? The primary job role is to teach and educate young students. The tutors take the help of technology to reach thousands of students and teach them the opted subject. So, it is very crucial for the teacher to be physically and mentally fit. They are the ones shaping the future of the country so the startups and EdTech companies need to protect the overall well-being of the employees.

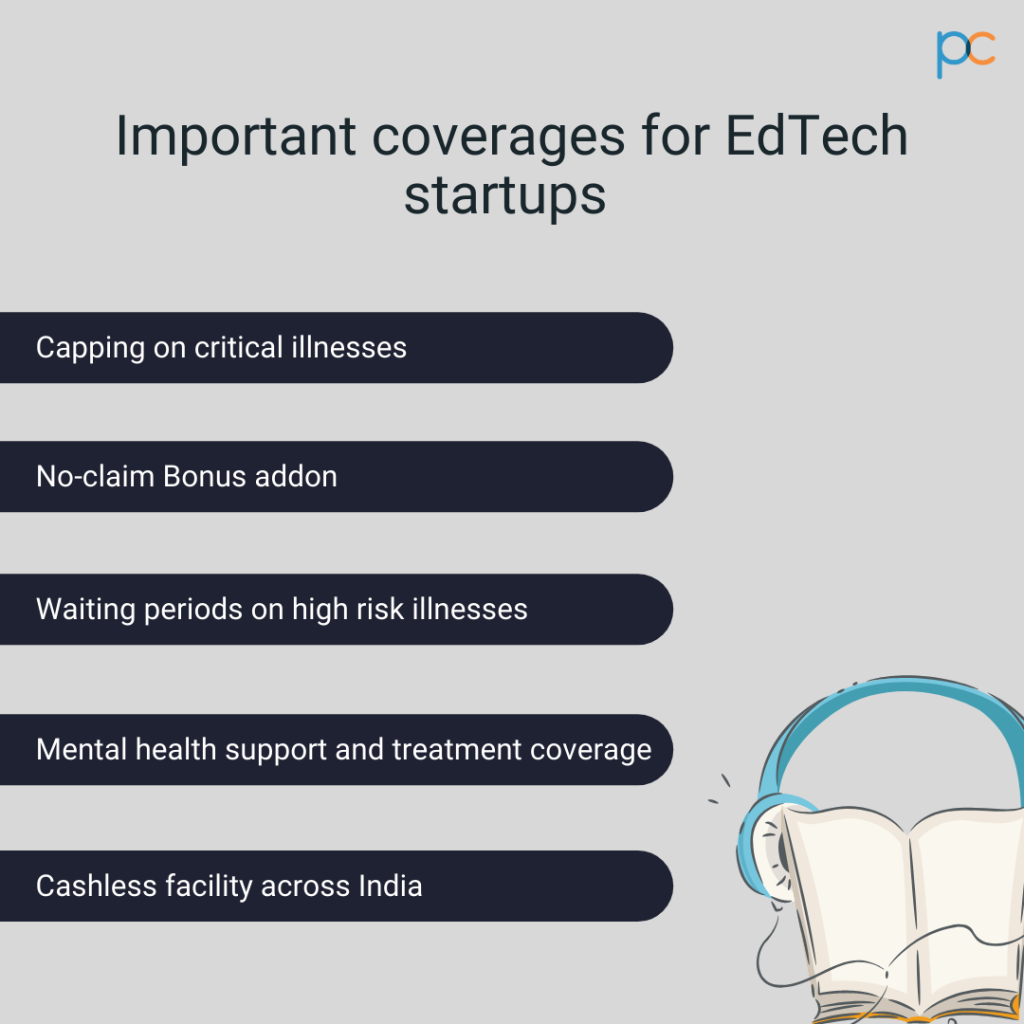

So, unlike other industries where they may not focus on finding a group policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More that covers the psychological healthcare of the employees, EdTech companies have to ensure this factor. The best group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More for the EdTech industry should offer psychological and therapeutical treatment support. Not every insurance company offers this benefit, so you have to browse well before purchasing.

- Cashless treatment under leading hospitals across India

Cashless treatment with a wide network of hospitals is a must for group healthcare insurance. With cashless facilities, the employees can enjoy a treatment at the leading hospitals all-over India. As most of the employees have the chance to work remotely in the EdTech professions, so providing them a pan India coverage is necessary. Cashless hospitalization allows the employees to release the stress of finding a hospital bed during medical emergencies. They can produce the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More documents and get admitted for proper medical reasons.

- Extended coverage for specific diseases

In the current scenario, providing covid-care medical coverage has become an integral part of the group healthcare plans. Other than covid care, the group Mediclaim should also offer extended support for critical illness coverage (ailments like diabetes, cardiac diseases, kidney issues, etc.). It eases the needs of the employees as they get to enjoy extensive healthcare coverage without paying any extra penny. As a startup, it can be tough during the initial years to bear the high cost of affording customized group healthcare plans. In such cases, you can offer a sharing deal with your employees. They can pay the extra money for the add-on benefits while you take care of maintaining the regular healthcare premiums. But if your company is ringing enough profit, you should always go for paying the whole amount as a token of gratitude to your hard-working employees.

- No-claim bonus and other benefits

You must have noticed that EdTech employees are mostly young. It is rare to find employees over the age of fifty in EdTech startups. Why? Because it is a fairly new professional field in India. Hence, more young employees are trying their luck in the field. At any EdTech startup, the average age of the workforce is between twenty-five to thirty-five. With employees in the lower age band, the chances of claiming insurance coverage are less. So, as an employer, it will be beneficial for you to find a group healthcare plan that offers a lucrative no-claim bonus at year-end. It also helps in reducing the overall cost of renewal premium charges.

- Extensive plan coverage for various treatment

It is a must for the group healthcare policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More to cover the pre-and post-hospitalization treatment expense. The best plan should offer a plan coverage that meets the needs of all the employees. Daycare expenses, surgical costs, consultation fees, and much more should be a part of the offered insurance plan. It will help the employees to live a stress-free life and focus more on their work, improving the existing growth rate of your company.

- Family coverage benefits

An employer may or may not offer comprehensive plan coverage to their employees. It means the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More may or may not include the names of the dependent family members (spouse, children, parents) as policyholders. EdTech startups should always go for a comprehensive plan to retain the employees. Otherwise, the employees may leave for a better opportunity where they can avail of such benefits, as there are plenty of opportunities waiting for them in this booming professional sector.

- Active customer support from the insurance company

Having an insurance company that works efficiently can resolve multiple issues. Both employers and employees may need to seek the assistance of the company. An employer may reach out to them to revise the plans or enquire about any insurance aspect. In contrast, an employee may have to connect to them for claiming reimbursement or any other policy-related requirement. Thus, an efficient team is a must to resolve such necessities. Go for an insurance company that has a good market reputation with group healthcare plans. E-claims, online assistance, dedicated TPA centers and much more add to the overall efficiency of an insurance company. Ensure that the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More you purchase features all these qualities.

PlanCover – Your helping partner.

PlanCover, the leading insurance broker company, brings the most suitable group health insurance plans to employers and startup founders. EdTech startup owners can reach out to them even if their employee strength is low. PlanCover offers group healthcare policies from leading IRDAI-approved insurance companies to the employers of small to mid-scale organizations. If your EdTech startup has 7 to 450 employees, you can approach the proficient team of PlanCover to specify the features you need in the insurance coverage. They will bring the most customized group health insurance plan to meet the needs appropriately. Reach out to them to find the right policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

** https://kr-asia.com/indias-edtech-market-to-grow-5x-to-reach-usd-3-5-billion-by-2022-blinc-invest