Employer health insurance plans or group healthcare plans are currently among the mandatory service concessions in India. Post Covid-19, the government has set rules for the compulsory offering of employer medical insurance for the employees working in an organization. Any startup or business with an employee strength of seven can apply for the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More purchase. Many are unaware that the same rule is valid for part-time works as well. In an organization, if there are both part-time and full-time employees working under the same employer, then all of them can qualify for group healthcare benefits.

Table of Contents

Is it beneficial?

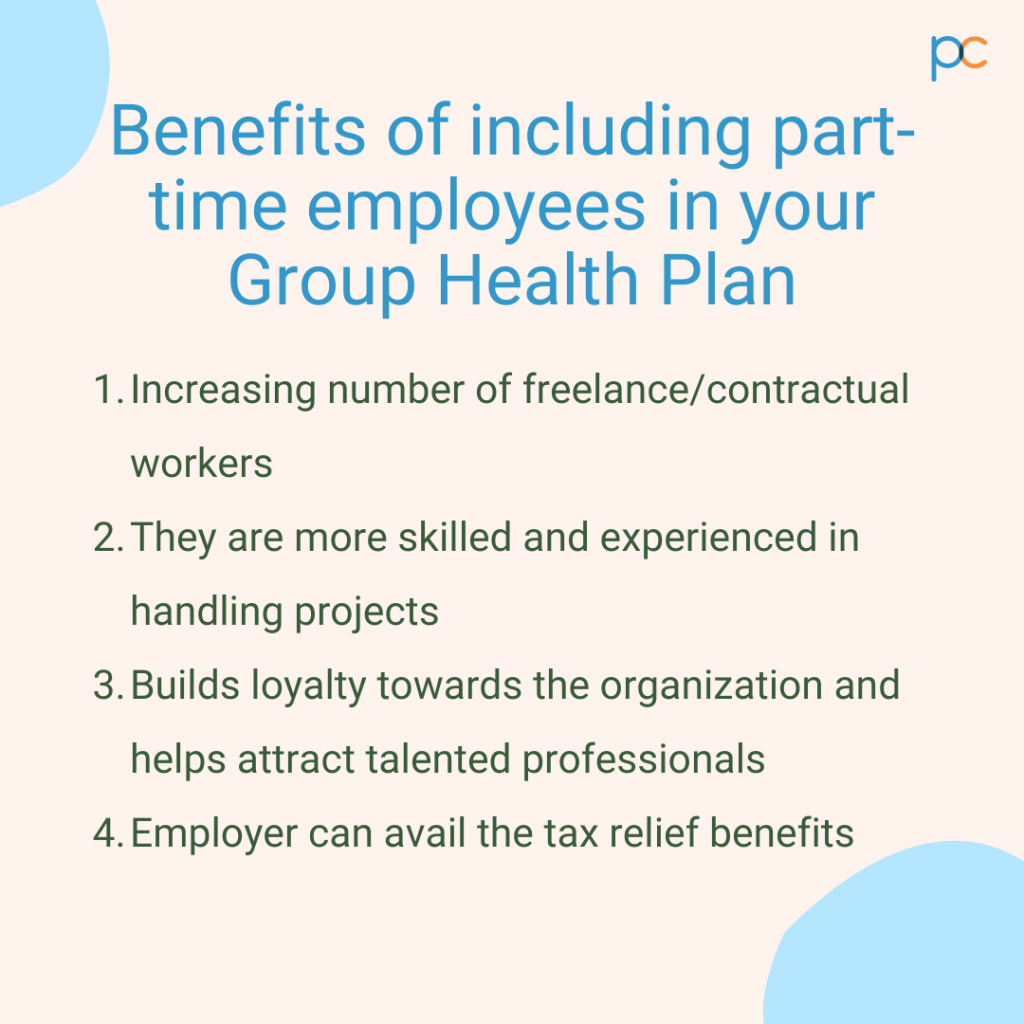

The way the employer healthcare insurance works is valuable in more than one way. It has advantageous factors for both employees and the employer providing it. After the lockdown in 2020, most organizations are purchasing the group medical policies for the government mandate. If you consider it from a long-term perspective, the group plan is equally beneficial for both parties.

- For employees: The benefits for the employees are plain and simple. The group mediclaim covers the medical expenses incurred for valid medical treatment. The employer pays the premium for which there is no added pressure on the employee to continue the plan benefits. They can enjoy the plan coverage till the last day of their service and, port the insurance into an individual plan if they want to continue it after switching the job. Few organizations also offer part-time employees comprehensive medical insurance where the dependent family members (spouse, children, parents) can also enjoy the treatment coverage. Thus, it is always beneficial for a part-time employee if their employer offers such medical plans.

- For employers: Employers are the ones to bear the responsibility of the group healthcare plan. Then how is it beneficial for them? The employers can also gain through the group healthcare schemes. The employees grow loyal to the organization for such plan benefits, increasing employee retention. Secondly, for payment of premium on behalf of the organization’s employees (part-time and full-time), the employer can enjoy tax relief. There are legal norms that qualify an employer to get a tax deduction on producing valid certifications of premium payment.

Features to find in the insurance

With so many medical insurance plans from distinct insurance companies, the selection can be confusing. An organization having both part-timers and full-timers needs a distinct approach while buying the policies. The employer has to find the right balance of features that satisfies the requirements of the part-time and full-time employees. But if the majority of the workers are part-timers, you may cut on certain added benefits from the plan. Going for a moderately serving plan for part-time employees serves both the interests of the employer and employee.

Coverage that meets the needs

It is always better to ask the employees what they look for in an insurance plan. As you provide the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More as a service benefit, keeping the needs of the employees in mind should be your priority. Select a plan that covers expenses for most illnesses and diseases. Even if there are varied waiting periods for certain disease treatments, it will not be an issue for part-time employees as they do not have a high expectation against their contractual service. And more importantly, most part-time workers keep extra medical insurance in their name to meet their needs. So, take a wise call in picking a group policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More.

A premium that does not exceed budget

As an employer, you cannot ignore the cost factor. It is you who has to pay the premium charges policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More continuation. Unless the part-time employees contribute a part of their salary for paying the premiums, you should always plan the budget. Look for insurance with a moderate premium rate that qualifies you to avail of the tax deduction. However, do not select the insurance based only on the lower premium rates. Go for the right combination of price and policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More features.

Cashless facilities and a wide network of hospitals

Cashless treatment facilities are a must, whether you offer the insurance to the part-time employees or full-timers. You should check the network of hospitals under the insurance company’s policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More so that your employees can get cashless admission in the hospital. It eliminates the financial burden off their shoulder and makes them motivated to work better for the company to avoid disruption of the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More coverage.

No-claim bonuses and offers

There may be zero claims for reimbursement or cashless treatment. But does that make the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More pointless? No. Be wise to find a plan where you can enjoy no-claim bonuses. Many insurance companies offer a no-claim bonus by reducing the premium. As your company mostly has part-time employees, there are high chances that they already own an individual Mediclaim plan. So, it is obvious that they will use their personal policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More in the first place for getting better medical benefits. Consider this practical fact and choose accordingly.

Easy reimbursement and settlement

Nobody has time to run between their schedules for getting the claims reimbursed. Unless the procedure for claim settlement is smooth and efficient, there is no point in keeping the insurance. Especially for part-time employees, there are high chances that they also freelance their services to increase their income. Thus, they cannot spare extra time for claim settlement. Before you buy the insurance, ensure that the company and the associated TPA have a good market reputation regarding their efficiency and functioning.

Flexible add-on features

Add-one plan benefits are of great use for part-time employees. Why? Because it allows them to use the medical insurance in a customized way. If they need expense coverage for a particular treatment then they can add it by paying the extra part. Most part-time employees would prefer this as they can add features like maternity benefits and critical illness treatment care as an add-on.

Day-care expenses and medical support

The Daycare expense coverage should be a part of the insurance plan. It includes expenses related to pathological tests, diagnostic expenses, a treatment that takes less than 24 hours of hospitalization, and much more. It helps shed the financial burden for part-timers who may need to visit the hospitals for minor treatment. The policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More you buy should offer such useful and advantageous features to ensure optimal utilization.

Buy from the best

How do you buy the insurance? Employers can directly approach the insurance company’s sales department to purchase the policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More. Or, they can find an insurance seller to help them out. An insurance broker offers more than one insurance from the leading insurance companies and offers the best plans that aptly match the requirements. You can consult with the experts and specify your budget to help them fetch you the right plan. Get the best insurance for the part-time employees working under you by going to a reliable insurance seller.

Find the right with PlanCover

PlanCover is one such high-rated insurance broker that can resolve all your insurance-related doubts. They sell the best policies to employers of small to mid-sized organizations. They listen to your specific requirements and then present the best alternatives that match the criteria. Buy the right policyAn insurance policy is a legally binding contract between an insurance company (insurer) and an individual or business (policyholder). It More at the best price by connecting to the team of PlanCover. You can rely on their expertise as they have immense market knowledge and experience in the field. If your organization has employee strength between 7 to 450, PlanCover is your one-stop solution. Reach out to their team now.