Room Rent Maximum Limits in Health Insurance

In-Depth Analysis: Room Rent Limits in Indian Health Insurance

Introduction

Health insurance in India is a financial safeguard against the high costs of medical care. The Room Maximum Limit is a key feature of health insurance policies that determines the extent of coverage for hospital room rent during a policyholder’s stay

Essence of Room Rent Limits

Room rent limits represent the maximum amount your health insurance company will reimburse for your daily hospital room charges. Exceeding this limit means you become responsible for the extra cost.

Understanding this limit is paramount for:

● Informed Room Selection: Room rent limits guide your decision regarding hospital rooms, helping avoid unexpected financial burdens.

● Potential Impact on Other Expenses: Some policies link room rent limits to coverage for other medical expenses. Selecting a room above your limit might lead to deductions across various categories, increasing your out-of-pocket costs.

Exploring Hospital Room Varieties

Hospitals in India offer a range of room categories to accommodate diverse patient needs and preferences. Here’s a closer look at the most common room varieties:

- General Ward:

○ Description: The most economical option, the general ward typically consists of a large room with multiple beds where patients receive basic medical care.

○ Benefits: Cost-effective, suitable for patients with minor ailments or those seeking budget-friendly accommodations.

○ Challenges: Limited privacy, increased exposure to noise and disturbances from other patients.

○ Insurance Coverage: Generally covered by most basic health insurance plans in India.

- Semi-Private Room:

○ Description: Semi-private rooms offer a balance between affordability and privacy. These rooms usually accommodate two to three patients and may include additional amenities.

○ Benefits: Improved privacy compared to general wards, relatively affordable.

○ Considerations: Reduced privacy compared to private rooms, potential for noise disruption.

○ Insurance Coverage: Many health insurance plans in India cover semi-private rooms, but coverage may vary. Review your policy for details.

- Private Room:

○ Description: Private rooms provide maximum privacy and comfort, with a single patient occupancy and attached bathroom facilities.

○ Benefits: Enhanced privacy, conducive to rest and recovery, suitable for patients requiring specialized medical attention.

○ Considerations: Higher cost compared to general wards and semi-private rooms, may not be covered by all insurance plans.

○ Insurance Coverage: Some premium health insurance plans may cover the cost of private rooms. Check your policy for coverage details.

Types of Room Rent Limits

● Fixed Percentage of Sum Insured: This is a common approach where the room rent limit is a fixed percentage (e.g., 1% or 2%) of your total sum insured. For instance, Mr Ramesh’s sum insured is Rs. 5 lakh and the room rent limit is 1%, the insurance company will cover a maximum of Rs. 5,000 per day for your room. a

▪ Hospital Stay:

○ Patient chooses a room costing Rs. 7,000 per day.

○ Duration of stay: 3 days

▪ Cost Impact:

○ Insurer covers Rs. 5,000 per day x 3 days = Rs. 15,000

○ Patient pays Rs. 2,000 excess per day x 3 days = Rs. 6,000

● Fixed Rupee Limit: Some plans offer a pre-defined fixed amount for room rent, regardless of your sum insured. This can be beneficial for budget-conscious individuals, but it might not be enough for higher-end rooms.

● No Capping: Premium policies may offer no cap, providing greater flexibility

● Capped by Room Category: Some plans set limits based on the room type chosen (single occupancy, twin sharing, etc.).

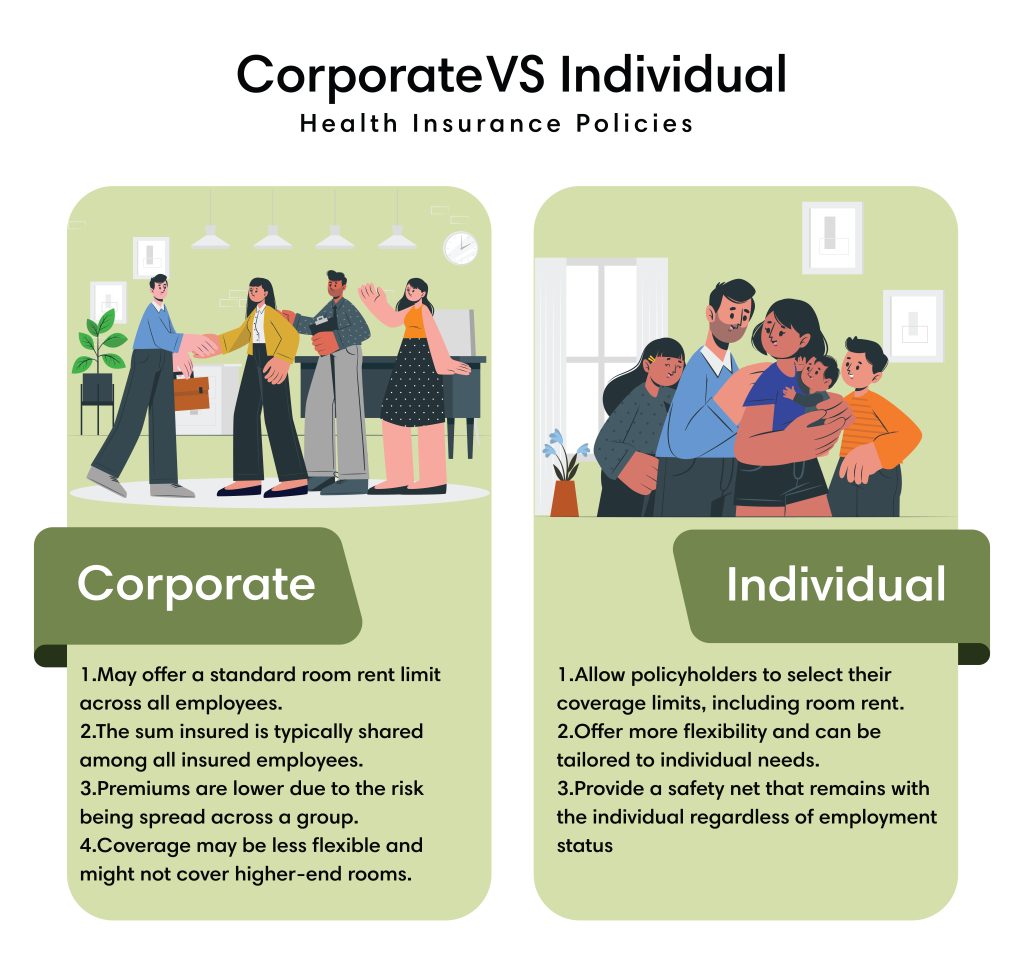

Corporate vs. Individual Health Insurance Policies

Corporate health insurance policies, provided by employers, often have different terms regarding room rent limits compared to individual policies purchased directly from insurers.

Choosing a Health Insurance Plan with the Right Room Rent Limit:

When selecting a health insurance plan, consider the following factors regarding room rent limits:

● Your Budget: Evaluate your comfort level with potential out-of-pocket expenses if you choose a room exceeding the limit.

● Medical Needs: Consider if you might require a specific type of room (e.g., single occupancy) due to medical conditions or personal preference.

● Hospital Choices: Research the typical room rates in the hospitals you might utilize to ensure the room rent limit is sufficient.

Understanding Proportional Deductibles in Indian Health Insurance

Corporate health insurance plans in India offer a valuable financial buffer during medical emergencies. However, a concept called “proportional deductibles” can sometimes lead to unexpected out-of-pocket expenses. Here we would like to shed light on this concept and empower you to make informed decisions regarding your health insurance treatments.

What are Proportional Deductibles?

Unlike a standard deductible, where you pay a fixed amount upfront before insurance coverage kicks in, a proportional deductible works differently. Here’s the key point:

● If you choose a hospital room exceeding the limit set by your insurance plan, the insurer might not only charge you for the room rent difference but also proportionally reduce the coverage for other associated medical expenses.

Understanding the Impact:

Imagine this scenario:

● Your corporate health insurance plan covers room rent up to INR 5,000 per day.

● You opt for a room costing INR 6,000 per day (INR 1,000 exceeding the limit).

● With a proportional deductible clause in your policy, the insurance company might not just ask you to pay the INR 1,000 room rent difference. They might also proportionally reduce their coverage for other associated medical expenses (doctor consultations, procedure charges and other services ) by a certain percentage (e.g., 20%).

Navigating Proportional Deductibles

● Awareness: Policyholders should be aware of the proportional deductible clause in their health insurance policy.

● Room Selection: Choose hospital rooms within the insurance coverage limit to avoid proportional deductions.

● Policy Review: Regularly review your health insurance policy to understand the coverage limits and any changes to the proportional deductible clauses.

Tips for Managing Room Rent Limits:

When purchasing a health insurance policy, it’s important to consider the room rent limit. Policies with no capping or higher room rent limits might come with a higher premium but can provide greater flexibility and peace of mind during hospital stays. Always read the fine print of your health insurance policy to understand the room rent limit and how it might affect your coverage.